Hong Kong’s Real Estate – Housing, Office & Retail Properties – Face “Tsunami-Like Shocks”

by Nick Corbishley, Wolf Street:

At first the protests and now the coronavirus collide with the World’s Most Expensive Property Market.

At first the protests and now the coronavirus collide with the World’s Most Expensive Property Market.

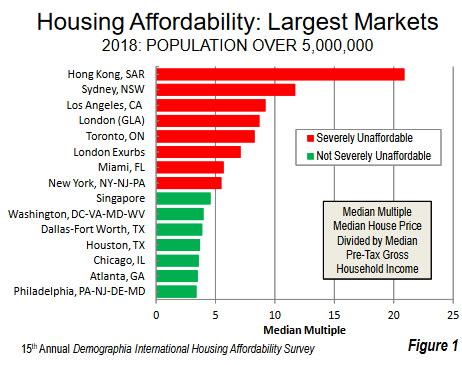

The world’s most expensive housing market in terms of affordability for a median-income household is in Hong Kong, which also happens to boast the highest ratio of financial assets to GDP on the planet. That market is under huge strain as it reels from months of virtually non-stop political protest, the ongoing trade war between its two largest trading partners, China, and the U.S., and now the recent arrival of the novel coronavirus.

Values of Class A office buildings in the city fell last year by 7%. It was the first fall since 2008, according to the commercial real estate services firm JLL. Prices of offices as a whole finished the year at their lowest level since the second quarter of 2018. “There was a lot to deal with in 2019, but most importantly the market had been expanding for 11 years,” according to the report. “At a certain point, that had to change.”

The total transaction value of office and retail properties as a whole slumped 12.9% last year to HK$49.6 billion (US$8.9 billion), according to Bloomberg Intelligence. By December, Class A office buildings were registering a 6% vacancy rate, the highest level since April 2010 when the city was struggling with the aftereffects of the Global Financial Crisis. Rents for the segment also fell 3.4% for the year.

But that pales compared to the reverberations being felt across the retail sector, whose sales declined by a mind-watering 19% year-over-year in December, according to Hong Kong’s Census and Statistics Department. Sales of luxury goods — a huge part of Hong Kong’s retail industry — slumped by 37%. Many retailers have gone under or closed stores, resulting in a vacancy rate in core shopping areas of 9%, the highest in five years.

Most of the blame lies with the political crisis that broke out last spring and escalated into a crescendo of violence in the summer that decimated tourist traffic, particularly from mainland China.

Then came the outbreak of Covid-19, which compelled Hong Kong authorities to shut six of the city’s borders with the mainland. Average daily tourist arrivals plunged by 97% to 3,000 in early February from 200,000 a year earlier while many local residents have cut back on all but essential purchases, choking off retail demand.

So spooked are commercial real estate landlords by the scale of the slowdown that some have begun providing rental relief to help their tenants weather the storm. Henderson Land Development, the city’s third-largest developer, offered to slash rent by 60% to help out retailers. Hong Kong’s toy billionaire Francis Choi Chee Ming offered to lop 44% off rents at a 15,000 sq ft space at Plaza 2000 in Causeway Bay, after Prada refused to pay HK$9 million in monthly charges.

Keith Wu Shiu-kee, CEO of Sunlight Real Estate Investment Trust, a unit of Henderson Land Development, believes the impact of the virus on retail sales is likely to be far worse than during the protests, noting that in the second half of 2019 at least some tourists from the mainland were still arriving. He estimates that the plunge in total retail sales this year will be “clearly double-digits,” he said. “Whether it is 30%, 40%, or 50%, remains to be seen.”

Hong Kong’s residential real estate sector has so far weathered the storm slightly better, with home prices dropping 6.1% from a record high in June, according to the Centa-City Leading Index. The index even rebounded slightly in the four weeks through Feb 9 despite coinciding with the outbreak of COVIN-19 and the adoption of increasingly extreme measures by the Chinese and Hong Kong governments to contain its spread.

Loading...