Fed Is Now Trapped: If Powell Fails To Taper “Not-QE”, He Will Admit It Was “QE 4” All Along

from ZeroHedge:

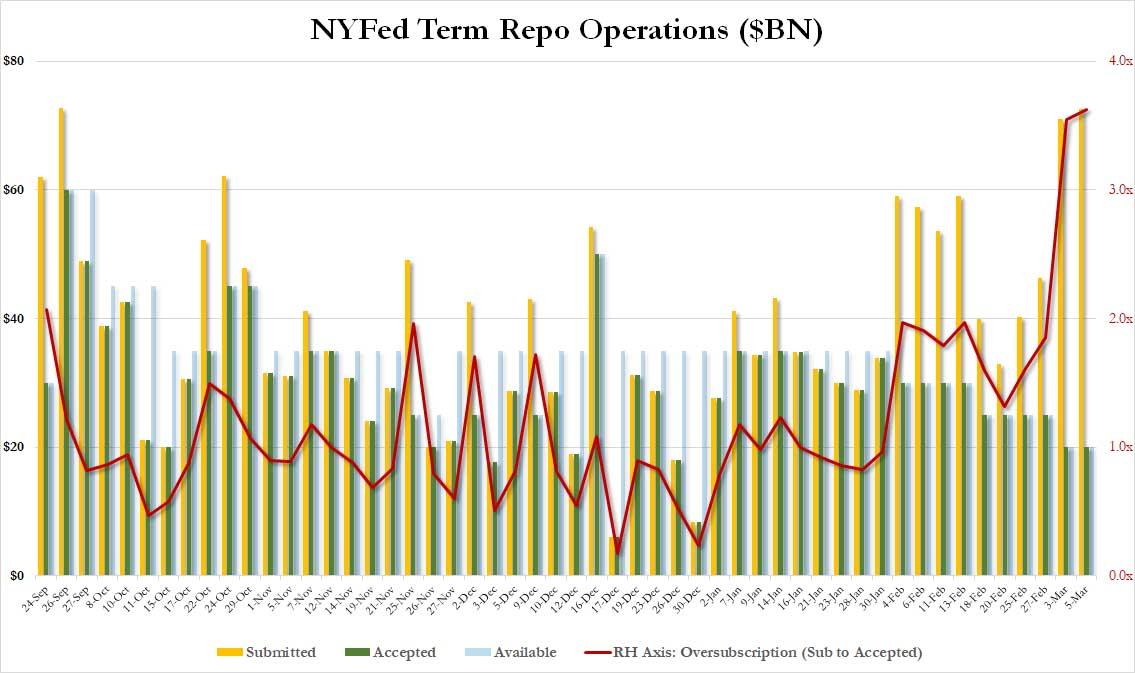

The unexpected scramble by dealers to obtain repo funding in recent days has taken the market, and especially STIR traders by surprise: after all, the primary catalyst behind the Fed’s decision to (emergency) cut by 50bps was to ease financial conditions. And yet the record oversubscribtion in both term and overnight repos in the past few days confirms that contrary to the Fed’s expectations, market liquidity has in fact deteriorated sharply.

And yet, as liquidity gets worse in response to the coronavirus market shock and, paradoxically, the Fed’s rate cut, the Fed faces a conundrum: will it continue tapering its repo operations and the permanent purchases of T-Bills, as it promised previously it would… or will the Fed capitulate and no only no longer taper, but in fact boost the availability of these products.

Herein lies the rub: if the Fed does in fact capitulate as most expect it to do, it will be effectively admitting that “Not QE” was in fact QE4 all the time, as this website and a handful of other Fed critics have claimed all along, and will make yet another mockery of all those finance hacks who, living in their mom’s basement, claimed that the Fed’s QE4 was not in fact QE4.

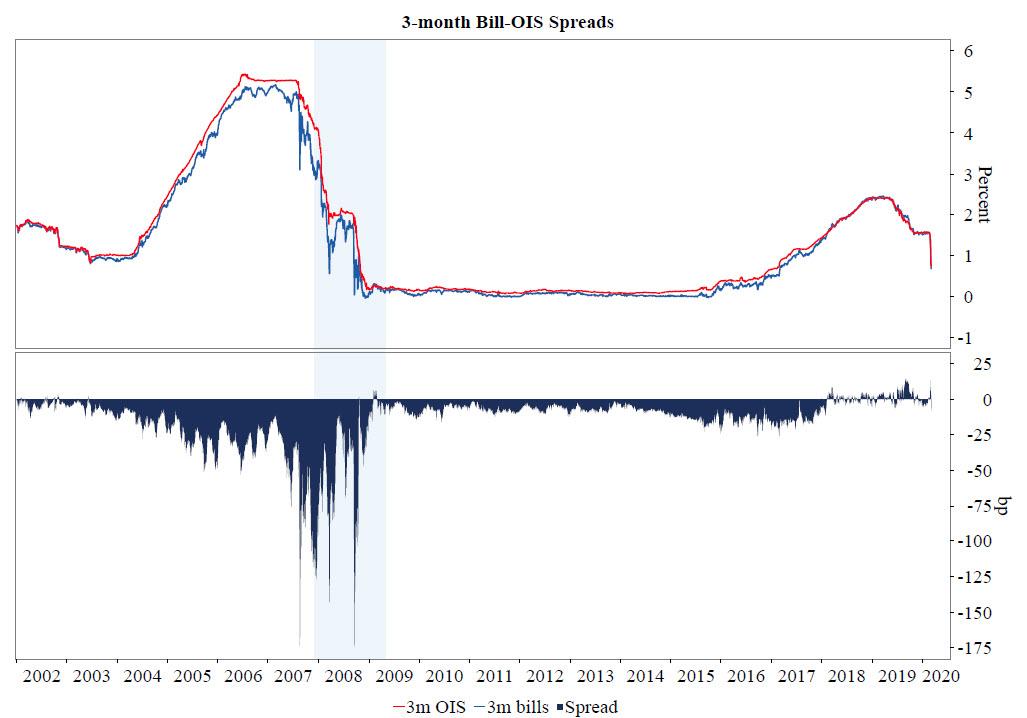

Addressing precisely this issue, on Thursday morning BMO’s rates strategist Jon Hill discusses the recent divergence in the 3M Bill-OIS spread…

… and touches on the various factors that he thinks would have an impact on a possible compression of the front-end Treasury/OIS spread, where he highlights “the possibility the Fed calls off tapering the bill purchase program”, although as noted above, he admits doing so would signal the Fed’s critics were right all along, and would be a prelude to the Fed losing even more credibility. To wit:

Loading...