US Airline Stocks Crushed. Southwest Warns on US Domestic Demand. UK Airline Collapses, Abandoned by Its Coronavirus-Spooked Owners

by Wolf Richter, Wolf Street:

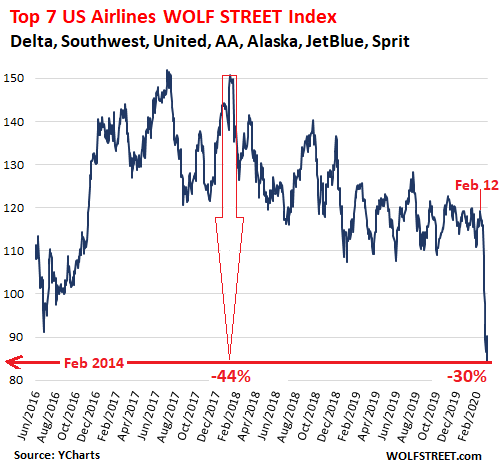

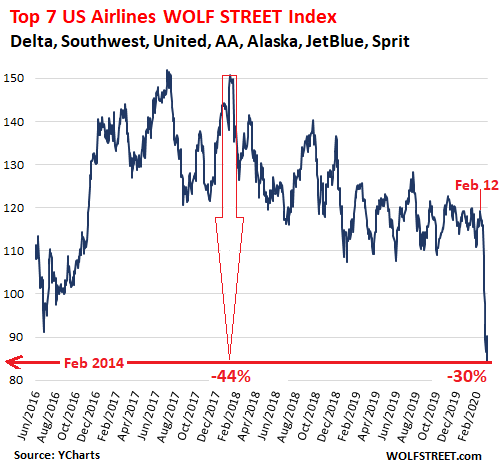

Estimated hit to global air passenger revenues quadruples to $113 billion. Stocks of top-seven US airlines plunged 30% in 15 trading days, after getting massacred today.

Estimated hit to global air passenger revenues quadruples to $113 billion. Stocks of top-seven US airlines plunged 30% in 15 trading days, after getting massacred today.

The shares of the top seven US airlines reacted sharply today, with drops as of mid-afternoon ranging from -6.8% for Delta to -16% for Spirit Airlines, which is now down 49% since January 17 before the coronavirus threatened the travel industry. Since January 17:

- Delta Air Lines [DAL]: -28%

- Southwest Airlines [LUV]: -18%

- United Airlines [UAL]: -35%

- American Airlines [AAL]: -42%

- Alaska Air Group [ALK]: -34%

- JetBlue Airways [JBLU]: -27%

- Spirit Airlines [SAVE]: -49%

But the plunge got going seriously after February 12, essentially forming a straight line down, with the value of the top seven US airlines plunging a combined 30% in 15 trading days (market cap data provided by YCharts):

Amid a constant drumbeat of airline warnings of capacity cuts not only on international flights to affected areas but now also within the US – and within the domestic markets of other countries – the International Air Transport Association (IATA) released its new estimates this morning of the potential damage to passenger revenues for airlines. But it has not yet released estimates for the potential damage to the air cargo business.

The IATA’s new estimates see a spectrum between two scenarios for 2020:

- In the “limited spread” scenario, where the virus is “contained in the current markets with over 100 cases as of March 2,” global passenger revenues would take a $63-billion hit, or 11% of revenues in 2020.

- In the “extensive spread” scenario, where the virus is in “all markets that currently have 10 or more confirmed COVID-19 cases as of 2 March,” and “with a broader spreading” of the virus, global passenger revenues would take a $113-billion hit, or 19% of revenues in 2020.

This extensive-spread scenario nearly quadruples the prior estimate of just two weeks ago, when on February 20, the IATA saw a hit of $29 billion to global passenger revenues in 2020, most of it relating to markets associated with China. Now it has become clear that the virus has spread far beyond China, and that it impacts ticket purchases on routes far beyond China, such as even domestic flights in the US.

“In little over two months, the industry’s prospects in much of the world have taken a dramatic turn for the worse,” said the IATA report, which pleaded for governments to step in and provide relief for airlines. And it added, “It is unclear how the virus will develop, but whether we see the impact contained to a few markets and a $63 billion revenue loss, or a broader impact leading to a $113 billion loss of revenue, this is a crisis.”

Airlines hanging on by their fingernails will let go or get a bailout.

The first to let go was UK airline Flybe, and its sister carrier Stobart Air, which were grounded Thursday morning and entered bankruptcy administration. Passengers were left stranded. Flybe accounted for well over one-third of the domestic flights in the UK.

Flybe was acquired in January 2019 by Connect Airways, a consortium consisting of Virgin Atlantic, Stobart Group, and investment advisory firm Cyrus Capital Partners. The airline was already teetering at the time, and the consortium picked it up for a song (about £2.8 million).

The consortium injected some cash into the airline, most recently in January, and the government provided some relief on payment terms of the air-passenger tax. But a hoped-for larger bailout from the government didn’t happen. And given the stress put on the airline industry as a whole by the coronavirus, the consortium decided not to fund the airline further. And abandoned by its owners, it collapsed today.

Other weak airlines will either collapse as well, or will be bailed out. The Chinese government has already taken over HNA Group, the conglomerate that owns about 18 airlines in China and Hong Kong.

Another airline on this list is Norwegian Air Shuttle ASA, which has been losing a ton of money with its low-cost international flights. It forced its bondholders last year into what was effectively a debt restructuring. Today it withdrew its guidance due to the coronavirus. Its shares plunged 13% today to 15.85 Norwegian Krone (= $1.70), having lost 94% since their spike in August 2018.

Loading...