What Can The Fed Do? Print & Buy, Buy, Buy... Stocks

Everyone with a pension fund or 401K invested in stocks better hope the Fed becomes the buyer of last resort, and soon.

Much has been written about what the Federal Reserve cannot do: it can’t stop the Covid-19 pandemic or reverse the economic damage unleashed by the pandemic.

But let’s not overlook what the Fed can do: create U.S. dollars out of thin air and use these dollars to buy assets either directly or through proxies.

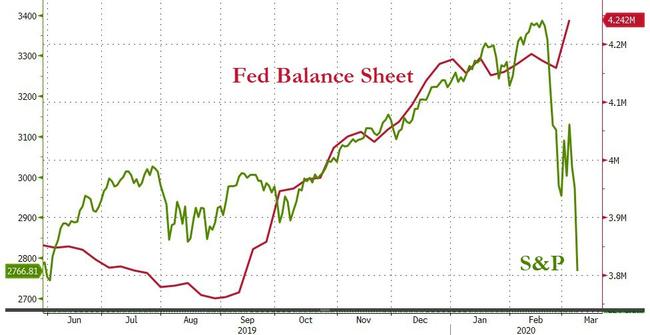

Let’s also not overlook how much the Fed can print/buy. The Fed’s balance sheet currently stands at $4.24 trillion. Doubling this to $8.5 trillion would bring the balance sheet to 39% of U.S. GDP ($22 trillion) and 7.5% of total U.S. household assets ($113 trillion). In the context of GDP and household assets, doubling the balance sheet would be extraordinary but not destabilizing.

Note how the the Fed’s balance sheet remained flatlined for 10 weeks and only popped higher this past week:

- 12/25/19 $4.165 trillion

- 1/1/20 $4.173 trillion

- 1/8/20 $4.149 trillion

- 1/15/20 $4.175 trillion

- 1/22/20 $4.145 trillion

- 1/29/20 $4.151 trillion

- 2/5/20 $4.166 trillion

- 2/12/20 $4.182 trillion

- 2/19/20 $4.171 trillion

- 2/26/20 $4.158 trillion

- 3/4/20 $4.241 trillion

Why would the Fed double its balance sheet? One reason would be the Fed moves from being the lender of last resort to the buyer of last resort, that is, the buyer of iffy assets no one else will buy such as junk corporate debt and junk bonds.

Why would the Fed become the buyer of last resort? To keep the entire financial system from collapsing under the weight of junk debt and fast-evaporating collateral.

Much has been written about the divide between financialized assets and the real economy, including many posts on this site. The financialization of the economy has richly rewarded the top 10% at the expense of the bottom 90% (and rewarded the top 0.1% at the expense of the top 10%), and this has generated socially and economically disruptive wealth and income inequality.

But even as we decry the widening gap between the financial sector and the real-world economy, we have to deal with the reality that the entire economy has been financialized and is now dependent on debt, leverage and asset bubbles.

If the stock market drops 50%, that wipes out pension funds, 401Ks, and mountains of leverage.

In other words, the Fed has to save all the asset bubbles to save the real-world economy which is now dependent on the excesses of financialization that have enriched the few at the expense of the many.