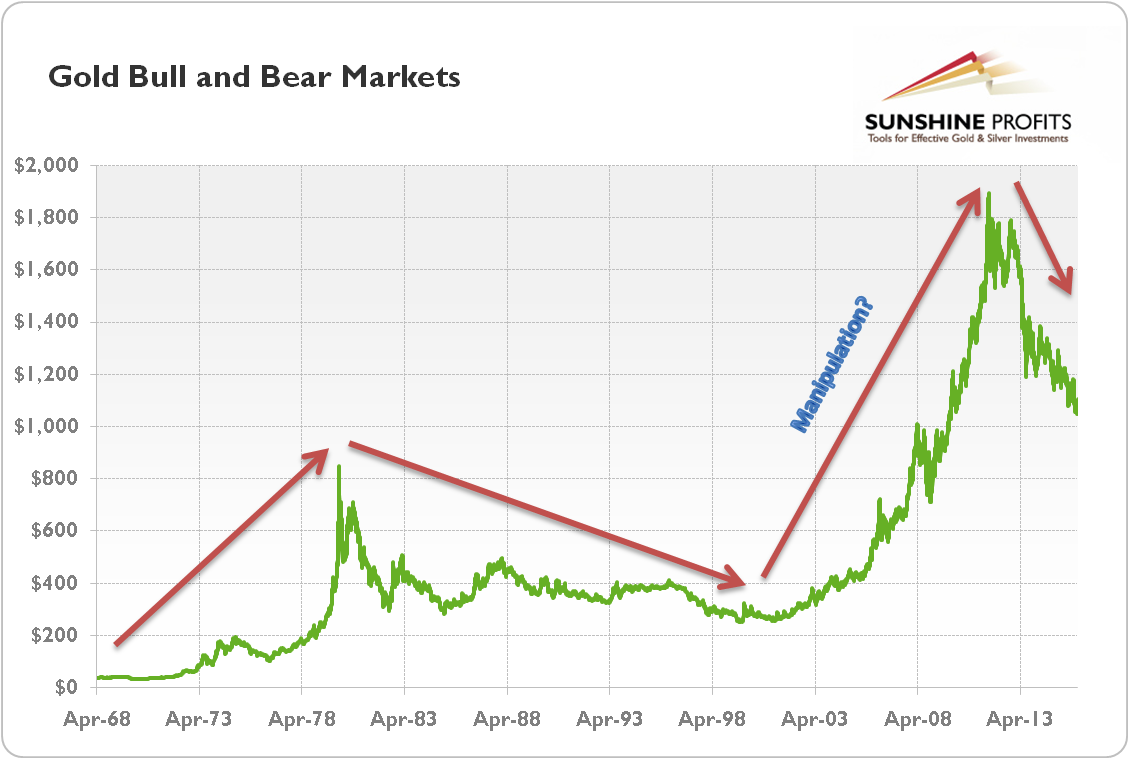

Is This the End of Gold or the End of Gold Market Rigging?

by Chris Powell, Gold Seek:

Dear Friend of GATA and Gold:

How much of last week’s smash in monetary metals prices was caused by what seems to be the primary explanation for it — selling required to meet margin requirements for positions in other markets that were falling amid the worldwide virus panic?

Surely there was some of that, but suspicion also must fall on governments and central banks seeking, as they long have done in times of crisis, to bolt the exits from the financial system, which they control. This suspicion must be especially strong because of what GATA disclosed last week — the refusal of the U.S. Commodity Futures Trading Commission to answer a member of Congress as to whether the commission has jurisdiction over manipulative futures trading conducted by or for the U.S. government and whether the commission is aware of such trading:

Fifteen years ago GATA’s friend, the late Peter George, remarked on this point on the eve of GATA’s Gold Rush 21 conference in the Yukon.

“In the last 10 years,” George said, “the central banks have effectively shown that when there is a real crisis, gold actually goes down — and it’s so blatant, it’s a joke.”

Video of George’s comment can be seen at the 38-second mark of the video at the top of the page here:

Adding to evidence that last week’s smashing of the monetary metals in the futures markets was indeed the most desperate move yet by governments and central banks are reports from coin and bullion dealers about the simultaneous explosion in their business.

The proprietor of the Bullion Star dealership in Singapore, Torgy Perrson, described this at length in a letter to customers on Thursday.

https://www.bullionstar.com/blogs/bullionstar/gold-shortages-price-of-ph…

“The last few days have been our busiest days of all time,” Persson wrote. “The enormous increase in demand is straining our supply chains. Bullion Star has supplier relations with most of the major refineries, mints, and wholesalers around the world. Most of our suppliers don’t have any stock of precious metals and are not taking orders currently. The U.S. Mint, for example, announced that American Silver Eagle coins are sold out. The large wholesalers in the U.S. are completely sold out of all gold and silver and are not able to replenish. …

“While there is unprecedented demand for physical gold, this is not reflected in the gold price as derived by Comex and the London unallocated spot market.

“It is abundantly clear that the physical gold market and paper gold market will disconnect. If the paper market does not correct this imbalance, widespread physical shortages of precious metals will be prolonged and may lead to the entire monetary system imploding.”

Disparities between the paper and physical markets in the monetary metals have developed after previous government attacks, but perhaps never to the current extent. The extreme nature of the current disparity has prompted some people to wonder if this attack is meant to enable some cleanup of the government-instigated and underwritten short positions in the futures markets and a general resetting of the financial system, insofar as so much else in the system is out of whack or not functioning at all, as with negative interest rates and the issuance of fantastical amounts of electronic money by the Federal Reserve to its investment bank agents.

As a close observer in Britain writes:

“I have never seen such crazy trading as recent days and yesterday was ridiculous since, while gold itself was down only around 3 percent, the mining shares were down on average more than 10 percent. In isolation those numbers are not necessarily out of line, but the latest hit to the equities came after several other big hits in the week. Moreover, yesterday saw general equities achieve a modest recovery.

“I am unable to substantiate my gut instinct, but I’m sure that there was a huge push made yesterday to get the gold-related equities down in order to break any ideas that gold and mining shares are a safe haven. It feels as if this week has been price suppression on steroids.

“If I’m right then at some point in the next few weeks, probably with little comment and only progressively, we will see a recovery back to prior levels of gold and the related equities.

Loading...