As Infinite Money Chases Collapsing Production, Gold Is on Call

by Chris Powell, Gold Seek:

Dear Friend of GATA and Gold:

A few observations on the turmoil in the financial system.

1) Because of the virus epidemic, economic production is being sharply curtailed around the world and likely will remain sharply curtailed for some time.

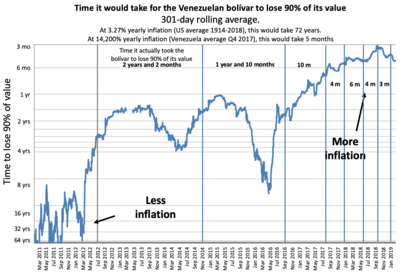

2) Accordingly, personal incomes are being sharply curtailed too, so there is talk of “helicopter money” to replace incomes. But “helicopter money” won’t restore production, just support demand and reduce personal debt defaults.

3) Every hour billions or trillions in dollars and other currencies are being created and thrown at problems here, there, and everywhere, even as production declines. This may evoke Kipling’s observation from “The Gods of the Copybook Headings”:

But though we had plenty of money,

There was nothing our money could buy.

His poem, written a century ago, is an even better reprimand of the current age:

http://www.kiplingsociety.co.uk/poems_copybook.htm

4) Corporate debts are becoming unservicable as business has been suspended or cut way back. The Federal Reserve today undertook to assume many of these debts.

5) Negative interest rates, common elsewhere, now are coming to the United States too, so the cost of holding dollars may exceed the cost of holding monetary metals. The disparagement of gold long has been that it doesn’t pay interest. Of course gold does pay interest for financial institutions in a position to lend it, just as government money has paid interest, so this disparagement has always been false. But now government currencies not only fail to pay interest but are openly devalued when banked.

6) All this would seem to foretell inflation, debt defaults, bankruptcies, currency devaluation — and gold and silver revaluation, either by government devaluation policy or by the markets themselves when the paper market for the metals is overtaken by the physical market. The recent sudden disparity between metal futures prices and physical coin and bullion prices again indicates that there has been massive government intervention in the futures markets and that futures prices are illusions.

7) The success of a system of infinite money requires infinite commodity price suppression to defend government currencies. Gold price suppression has been central bank policy since the London Gold Pool of the 1960s. But not only are government currencies becoming harder to defend amid the dislocations caused by the virus epidemic, governments no longer may want to defend their currencies so much. They want to reflate asset valuations. But even before the virus epidemic, equities and bonds already were highly overvalued by traditional measures, and how can they be worth as much as they were now that world production is declining? Only devaluation of currencies can accomplish reflation.

8) As has been noted by economists many times, rising monetary metals prices can help governments devalue their currencies and the economy’s debts. See the Scottish economist Peter Millar’s 2006 analysis of this issue:

Loading...