DECLASSIFIED: GOLD MINES SHUTTING DOWN – UNHEARD OF!

by Mac Slavo, SHTF Plan:

What a PERFECT set up for gold!

Seriously, can ANYTHING ever compare to the CHAOS that we now are UNDERGOING as a species?

- Bankruptcies, Defaults & Delinquencies: We haven’t even SCRATCHED THE SURFACE!

Don’t think for a second that this ISN’T COMING!

About 100 companies in the S&P 500 index have already SUSPENDED DIVIDENDS, which is the responsible thing to do, but it also points to the REAL-LIFE conditions of businesses.

Many real estate funds have told investors that there will be NO DISTRIBUTIONS until this pandemic blows over. What markets don’t WANT TO UNDERSTAND is that there’s at least a 12-to-18-month LAG between the time that governments give people the ALL-CLEAR sign from the medical professionals and the time that people actually feel confident.

These next 12-18 months will USHER IN a wave of bankruptcies, mostly for small businesses.

- Shot Out of a Cannon: The markets came ROARING BACK because of the $12T and counting of financial aid, subsidized by Washington and loaned from the Federal Reserve, but we must BE CAREFUL not to confuse this SLINGSHOT EFFECT with fair value.

We have published our WATCH LIST, which shows you where we believe prices start to look appealing.

Mortgages TOTALING close to $150 billion in commercial real estate – a QUARTER of outstanding debt – have borrowers that are on the hook and have BEGGED for leniency from creditors.

In other words, what I’m saying is that we don’t see a BACK-UP-THE-TRUCK moment in equities yet because it’s being delayed by the stimulus. We had a brief one in March, picked up what we could back then, and will be JUMPING ON BARGAINS (if and when they arise), but for now, GOLD is our primary position.

Courtesy: Zerohedge.com

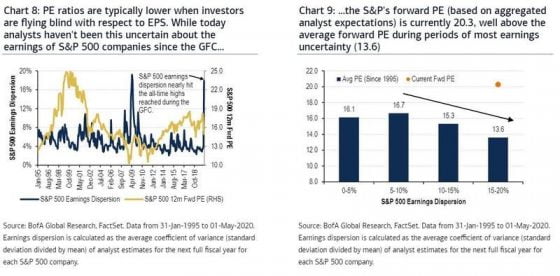

Crises and recessions end with LOW P/E MULTIPLES, not with record-high ones!

April 2020 has been the best month since January 1987 for the Dow Jones Industrial Average, so you can READILY SEE why this is complete nonsense.

The markets might be FORWARD-LOOKING, but with Markit Manufacturing and Markit Services at record lows, ISM Manufacturing collapsing and ISM Services lowest since 2009, and with NEARLY 66% of small businesses (500 or fewer employees) stating that they have 90 days of cash left, the markets are TOO forward-looking.

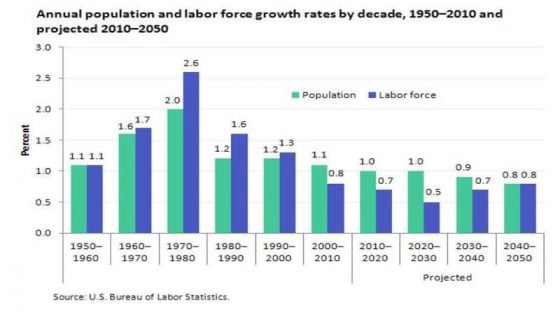

Notice that DEMOGRAPHICALLY, we are entering a period similar to that of the late 1960s, where the labor force is INCREASING DRAMATICALLY compared to the general population!

In terms of inflation, that is the MAIN DRIVER, going forward.

Chaos is what makes investors buy and hold gold, but inflation is what makes gold prices RISE FAST.

Between now and 2023, the markets will begin to price these demographic trends into their portfolios.

Loading...