The Fed is Dead!

by David Haggith, The Great Recession Blog:

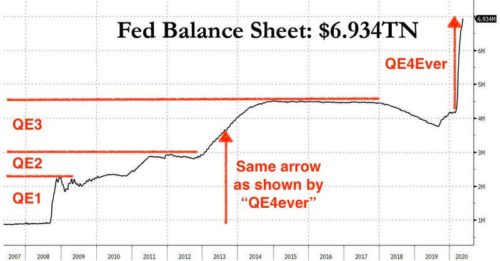

The last few months reveal how dramatic failure of the Fed looks now that it has hit the wall of diminishing returns. I’ve warned for years that the next recession would look just like what we are now seeing. I’ll show below why this graph shows in stark numeric terms just how bad it is.

I’ve said, since stimulus efforts began, that the belly of Great Recession was merely propped up into positive territory by vast amounts of artificial life support and that the Great Recession would reveal its true depth once the artificial life support finally ran out.

“Economic Collapse — The Train Wreck that is Happening Now!“

The next recession, I’ve written many times, will be something from which the Federal Reserve will not be able to extract us. It’s old ammo will not be enough. This graph and present circumstances prove we’re there.

QE used to be steroids for the economy; now the steroids are on steroids

It seems like a long time since I wrote the article titled “How Dead is the Fed?” It was, however, only back in March, and already the answer has crystalized in front of us.

Back then I wrote,

You can only be so dead, and that’s just “plain dead.” But there is also Feddy Krueger dead. The kind of dead that keeps on happening like a demonic death that won’t stay dead. It is in that nightmarish Elm St. light that I’m going to review the Federal Reserve’s death.

That is how the Fed dies. It keeps getting back up again and stabbed or chopped sent back down another time. Even back then, I wrote,

Let me pause to assure you, I’m not saying Feddy Krueger is down for the count and will not rise again. He always revives by inventing powers over market death never seen before. Feddy will return with extraordinary and permanent powers beyond those he once used to bring counterfeit salvation from the Great Recession. Feddy gets more empowered by scared government politicians each time the economy crashes. You can’t get rid of Feddy. At least, it seems.

That has already happened. The Fed, without any question, was allowed this week to start buying exchange-traded funds (ETFs) on the stock market to prop the market up a little longer, and the market is up again after a week of falling.

The Fed’s impotence as a zombie central bank, however, is clearer now than in March. The Fed’s increase in amperage in the graph above tells half the story. The obvious news already coming down the pipeline tells the other half.

Ignoring the period of “Not QE” that I said would evolve into QE4ever, which started in late 2019, look at what the Fed has done just since the start of the Coronacrisis in late February, 2020. The two vertical arrows in the graph are exactly the same size. (One is a copy of the other). In less than three months time, the Fed has done everything it did under QE1, plus everything it did under QE2, plus half of what it did under QE3! It did it all in less than one quarter!

In fact, the Fed has already done as much as everything it did in the first five years of its recovery efforts from the Great Recession. By the end of another month, the Fed will have done everything it did during the entire decade-long “Great Recovery” period and more!

A whole decadal recovery effort in one quarter! And what has the Fed gotten for that?

We still have an economy that is going deeper into recession and a stock market that has only recovered half of what it lost. While people crow about how fast the stock market has recovered, you have to weigh that bounce against the fact that stock markets always have major bounces right after major crashes … and then they fall some more. (See graphs near the end of “Fiercest Economic Collapse in History is Best Month for Stock Market.”)

Less bang for the buck?

For sure! The Fed’s Greatest Recovery effort to date brought about as much recovery back to stocks as we would have expected anyway.

Maybe all the Fed’s jolt juice made the bounce a little faster and a little higher. Maybe! (The bigger and steeper the fall, however, the more likely the bounce will be big and steep. This latest crash was the steepest in history, so I would expect the sharpest rebound in history.)

That’s lot less bang for the buck, given that it was a lot more juice!

The Coronacrisis accelerant

To be sure, this “recovery” period has the coronavirus accelerating all of the damage. What it also has that you hear almost no one in the mainstream media talking about (as if it were completely irrelevant) is all the economic flaws the Fed created over all those “recovery” years with its massive misallocation of assets that drove a wild search for yield.

The Fed’s getting a free pass on all that, but the Fed created the mess by permanently killing safe yields with permanently low interest rates. I always said there was no end game for getting off that road once the Fed held it in place as the new norm long enough for the economy to adjust around it.

We no longer have to rely on my claims that those interest rates will remain permanently low. We now know they will. We saw what happened when the Fed tried to raise those rates just a little — before the Coronacrisis — so we KNOW the Fed can never raise those rates without killing its recovery.

Read More @ TheGreatRecession.info

Loading...