CRASH LANDING: FULL STOCK MARKET STOP – RUN FOR YOUR LIFE!

by Mac Slavo, SHTF Plan:

Friday’s HUGE STUNNER, which saw unemployment numbers in America GOING DOWN, has brought back GRANDMA AND GRANDPA to the stock market, along with their MILLENNIAL grandchildren. Suddenly, retail investors are BULLISH like I’ve never seen!

Friday’s HUGE STUNNER, which saw unemployment numbers in America GOING DOWN, has brought back GRANDMA AND GRANDPA to the stock market, along with their MILLENNIAL grandchildren. Suddenly, retail investors are BULLISH like I’ve never seen!

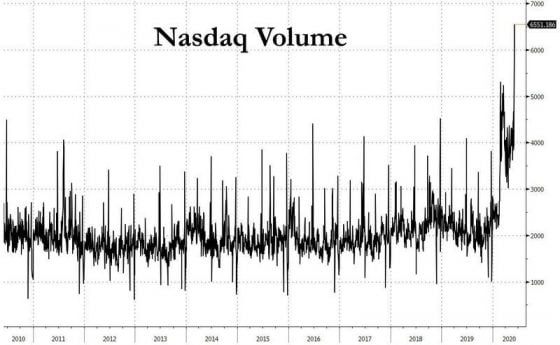

In fact (get this), the NASDAQ daily volume has reached a new RECORD-HIGH – not just any old high, but one set by a WIDER MARGIN from anything else we’ve encountered before!

Get a load of this:

Courtesy: Zerohedge.com

When the MARCH PANIC occurred, we received SCORES OF EMAILS from people expressing dismay that we didn’t dedicate ENOUGH PRINTED WORDS addressing the dangers of the Covid-19 market crash.

Now you can see why we always note caution and diversification but are never permanently bearish on the U.S. indices; the ENTIRE ECONOMY is based on the performance of them – the Federal Reserve and Washington WILL NEVER allow their precious baby to fall down the staircase.

The baby boomers’ net worth is tied to the stock market. The ability of the United States’ ruling class to issue debt, use leverage, exploit the middle class, and live like kings, ALL DEPENDS on a rip-roaring bull market.

This is especially true in times like these when COMPANIES are clearly much more valuable than government bonds.

But there’s a LIMIT to how much investors can pay for stocks and, IN MY OPINION, we’re nearing that point.

I don’t expect a massive crash, but what times like these call for is CHERRY-PICKING. The S&P 500 is expensive, but there are REAL BARGAINS within it. The market, as a whole, could see a mini-pullback (5%) and offer better ENTRY POINTS.

Some stats are important here:

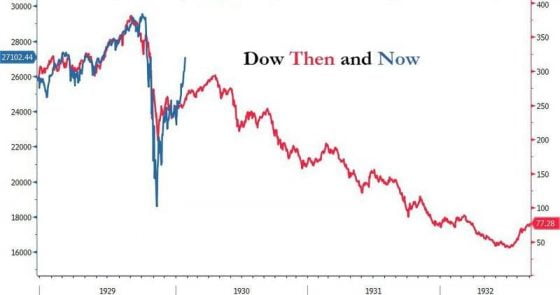

- There was an attempt to compare this CRASH/REBOUND to the Great Depression, plotting the two charts on top of each other.

Wealth Research Group ARGUED that this was TOTAL NONSENSE all along and we were DEAD-ON!

Courtesy: Zerohedge.com

Covid-19 is much more of a natural disaster than a recession. It didn’t originate because businesses were MANAGED BADLY or because investors were FOOLISHLY BETTING on risky stocks, nor because consumers were maxing out their credit cards or home equity lines. It originated because governments COULDN’T RISK taking a global pandemic too lightly and are now TRYING TO RECTIFY the damages of SHUTTING DOWN the global economy.

- Even after the RECORD-FAST rally back from the lows, there are STILL 115 companies in the S&P 500 index that are DOWN 20% or more this year. On top of those, there are an ADDITIONAL 207 companies that are DOWN between 0.1% and 20% this year.

Overall, 322 companies have DROPPED IN PRICE in 2020.

There are opportunities among them and we are working on our SHOPPING LIST PART 2 after the first one brought us UNBELIEVABLE RETURNS!

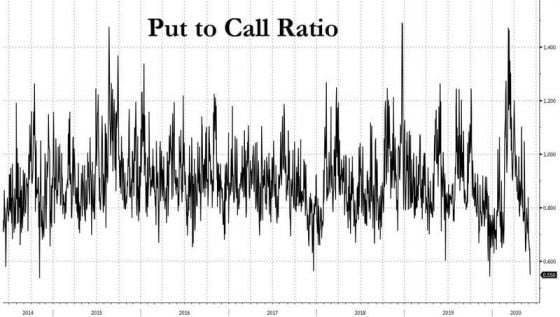

- Bulls are just BLINDED by the news right now. If we look at the put/call ratio and other measures of BULLISHNESS, we clearly see that mom and pop investors are FAR MORE TRIGGER-READY than Wall Street. In fact, Jeremy Grantham, one of the MOST LEGENDARY hedge fund managers to ever live, just initiated A SHORT POSITION on the markets!

In my career, I have RARELY WITNESSED instances where the general public was able to outperform Wall Street’s top money managers.

My point is that if retail is already positioned, no one is left to bid prices up in the near-term.

Courtesy: Zerohedge.com

I want to close with more thoughts on what’s happening in America right now, with regards to protests, riots, looting, and vandalism.

America has always been A BASTION OF FREE ENTERPRISE, filled with racial, gender, religious, social, and financial POLAR EXTREMES.

What makes it work is that PEOPLE realize that they are in control of their destiny. Our policemen, politicians, business leaders, rags-to-riches stories, protesters, and bad actors are NOT ALIENS, but the product of OUR COLLECTIVE way of life.