No V-Shaped Recovery? Cargo Vessel Calls Plunge At Singapore Port To Three Decade Low

from ZeroHedge:

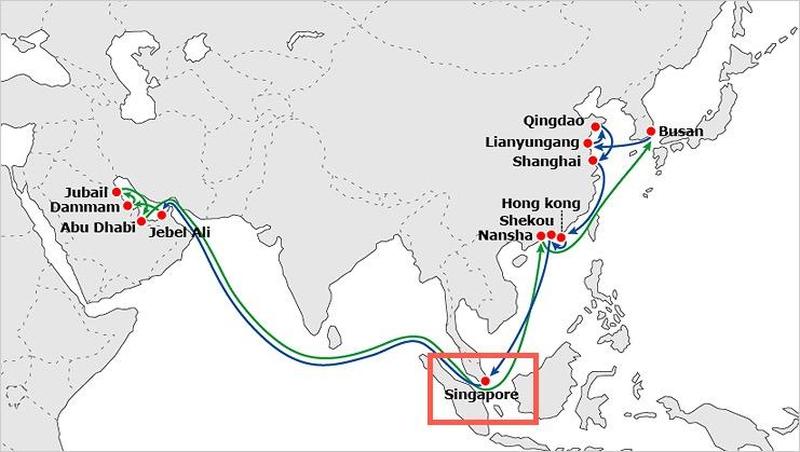

Singapore’s geographical location makes it one of the most important maritime trade lines connecting the global economy. It’s home to one of the largest ports in the world, on par with ones seen in Hong Kong, London, Shanghai, and Dubai. Port activity data via Singapore’s government is suggesting world trade has yet to recover, which means a V-shaped recovery in the global economy is unlikely in the back half of the year.

New data from the Maritime and Port Authority of Singapore (MPA) shows the number of vessel callings (otherwise known as port of call — an intermediate stop for a ship on its scheduled journey for cargo operation or taking on supplies or fuel) at the Port of Singapore sank in May to 3,059, the lowest since 1993, or near a three-decade low.

Containerized activity remained sluggish last month, despite the hopes for a recovery in world trade — Reuters notes shipping activity and bunker demand is expected to slump through June.

Blank sailings surged in the first week of June, with total blanked capacity nearing 4 million twenty-foot equivalent unit (TEU), research firm Sea-Intelligence said last week.

A plunge in world trade has severely weighed on marine refueling, or bunkering, activity in Singapore.

“COVID-19 finally caught up in terms of bunker trend,” a Singapore-based bunker fuel trader told Reuters.

Singapore bunker fuel sales volumes fell in May to 3.925 million tonnes, down 2% YoY, and -5% from April, reported MPA.

A.P. Moller-Maersk A/S, the world’s largest container line, warned not too long ago that world trade would continue to falter with declines extending well through 2Q20.

Maersk dashed all hope that a V-shaped recovery would be seen in the back half of the year, instead suggesting a U-shaped recovery is more plausible.

The World Trade Organization (WTO) published its Goods Trade Barometer in late May, which suggested a sharp contraction in world trade would extend through summer.