The Curious Case of COMEX Gold Deliveries in April and June

by Ronan Manly, BullionStar:

Did you think that the high-powered world of the LBMA would operate in a fishbowl for all to see? – ANOTHER

A lot has been written about the London gold spot price – COMEX gold futures price spread (EFP) blow up on 23/24 March, whose detonation has sent blast waves across the gold market on each side of the Atlantic, and whose trigger has been the subject of much speculation and debate.

Importantly, the fallout from this seismic event continues to roll on, and has caused unusual goings-on among the bullion banks in London and New York, such as:

– Deteriorating liquidity (bullion banks rapidly departing COMEX and London gold trading)

– Large trading losses at bullion banks, for example HSBC

– Gold borrowing rates rising over the time of the March event

– Bullion banks scrambling to secure physical gold to send to New York

– The SPDR Gold Trust ETF using gold stored at the Bank of England

– Sharp drops in COMEX gold futures open interest (OI)

– The launch of a COMEX 400 oz contract and 400 oz bars in COMEX vaults

– Huge volumes of gold bar exports from Switzerland to New York

– Record gold inventory build-ups in COMEX approved vaults

– Record numbers of COMEX gold contracts moving to delivery (June and April)

Is all of this connected you may ask? The answer in my view, is yes, but not in the way that you may think.

However, given the opacity of the wholesale gold market and the unconvincing explanations from its fronting organizations the London Bullion Market Association (LBMA) and COMEX operator CME Group (e.g. closed refineries, grounded flights), those looking for a ‘Theory of Everything’ framework to connect all of the above have had to do so on their own.

While Bloomberg and Reuters are content with repeating spoon-fed handouts about all of the above – eating the breadcrumbs instead of following the trail – and between them have published at least 30 articles on the subject, thankfully there are many on the sidelines who are more inquiring and less gullible, hence the skepticism, speculation and debate.

In an open and transparent market where full gold trade data including Exchange for Physical (EFP) and gold allocation trades were published in real time, all market participants would instantly assimilate and understand the late March event and its aftermath, and with those full facts the market would instantly and accurately be able to predict and monitor the succeeding chain of events – which by the way – are still in motion, a case in point being at the COMEX, where right now unprecedented numbers of COMEX gold futures contracts are moving into delivery.

Familiar to many, the Commodity Exchange (COMEX) owned by CME Group is the world’s largest gold futures trading venue, and although gold futures trading now takes place on CME’s Globex and Clearport electronic platforms, the COMEX has its roots as a New York exchange, and is hence synonymous with “New York” gold trading.

Most importantly, the COMEX 100 oz gold futures contract, along with the London OTC gold market, between them have a near monopoly on gold price discovery, and are the playground of the LBMA bullion banks such as JP Morgan, HSBC, Scotia, and Goldman Sachs which dominate and control both venues.

Electronic Warrants – The Delivery Process

The COMEX 100 oz gold futures contract is structured as a deliverable gold futures contract with delivery being in the form of an electronic warehouse (vault) warrant representing one 100 troy oz gold bar or three 1 kilo gold bars. . The gold backing these contracts is claimed to be in the network of COMEX approved vaults in New York City (and Delaware).

However, while COMEX 100 oz contract offers the ability to make and take delivery of gold in these vaults through a process of vault warrant transfers, normally in practice, the vast majority of COMEX 100 ounce gold futures are never delivered, they are offset (closed out) and cash-settled, or else rolled over to the next active month. Normally, only a tiny fraction of these gold futures contracts are ever ‘delivered’.

COMEX gold vault warrants contain information such as brand and weight of the gold bar that the warrant represents and which approved COMEX vault it is supposedly stored in. While a long contract holder can make its clearing firm and the Exchange aware that it wants delivery, it’s the short futures holder that actually submits the warrant for delivery (in a CME online app called Deliveries Plus), with the CME matching the warrant to the long and facilitating the transfer of title to the long.

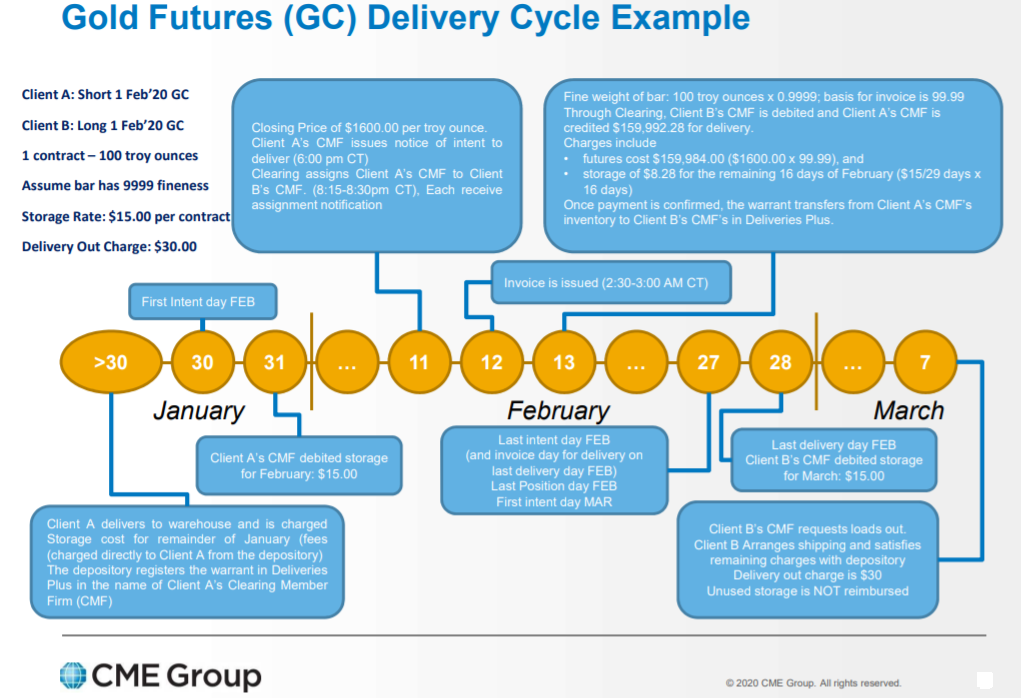

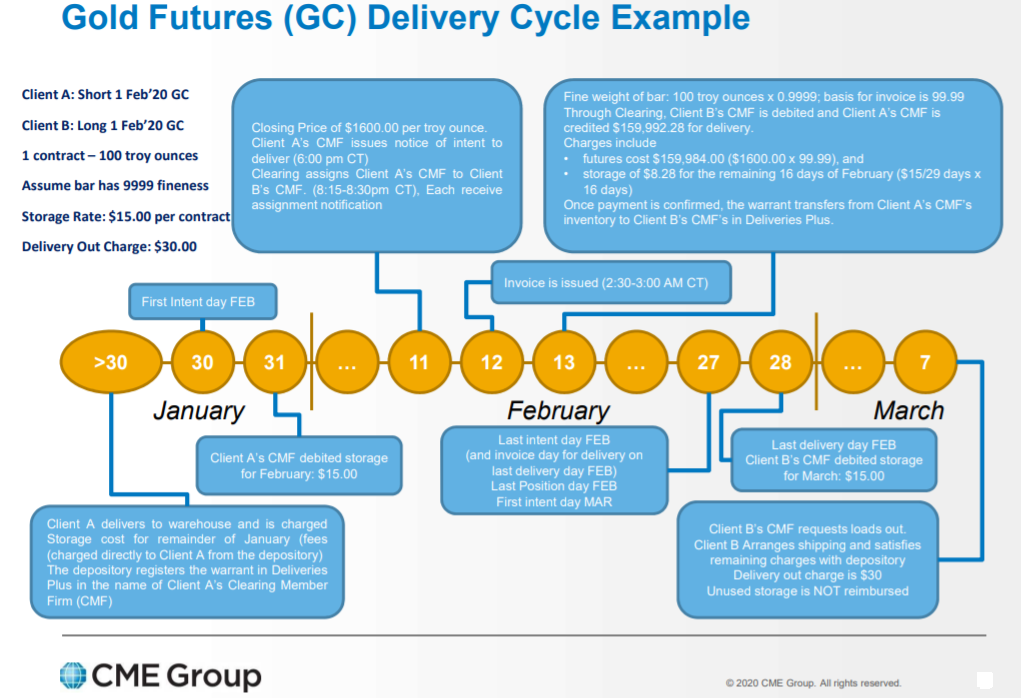

For delivery intent notices (see below), it is therefore the short who submits notice of intention to deliver a warrant, after which the CME clearinghouse matches the sides, issues allocation notices to the long and issues invoices to both parties. Delivery can then take place on any business day during the delivery month, at which point the short receives dollar funds and the long (buyer) receives the warrant (electronically) in the Deliveries Plus application. A presentation from CME which can be read here, explains the main steps of the delivery process.

Importantly, the buyer of the future (long) has no control over which of the COMEX vaults the warrant it receives refers to. It is the Exchange (COMEX) which assigns delivery to a specific vault. Note also that physical withdrawal of the gold bars underlying warrants is a totally separate step between the warrant holder and the vault where the gold is supposedly held and will involve transport costs and no doubt persistence to convince the COMEX approved vault to allow you to withdraw your gold bars.