Ted Butler: The Silver Pressure Cooker; hefty deposit into SLV

by Ed Steer, Silver Seek:

YESTERDAY in GOLD, SILVER, PLATINUM and PALLADIUM

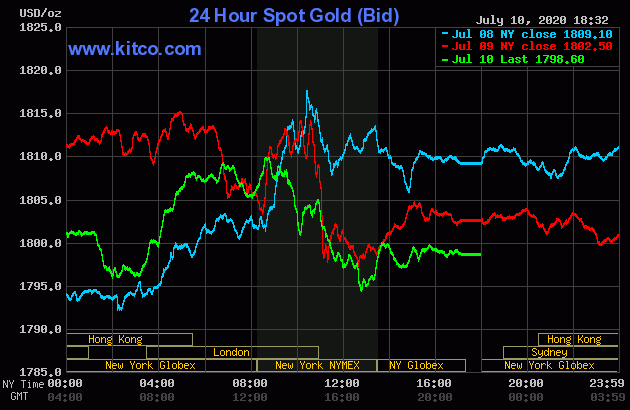

The gold price trended mostly unevenly lower in Far East trading on their Friday, with its Far East low coming at 2 p.m. China Standard Time on their Friday afternoon. From there it didn’t do much until shortly after the London open — and at that point, the dollar index began to head lower. The gold price rallied until the 10:30 a.m. BST morning gold fix — then it traded unevenly sideways, with the high tick of the day coming a few minutes after 8:30 a.m. in New York. It was sold quietly lower from there — and the low tick was set around 12:40 p.m. EDT. It was allowed to rally a bit from there, but the moment it poked its nose back above $1,800 spot, there was someone there to make sure it didn’t close above it — and it trended a few dollars lower until the market closed at 5:00 p.m. EDT.

The high and low ticks, both occurring in the COMEX trading session in New York, were recorded by the CME Group as $1,817.00 and $1,796.50 in the August contract. The July/August price spread differential at the close on Friday was $3.70… August/October was $13.70 — and October/December was $15.70.

Gold was closed in New York on Friday afternoon at $1,798.60 spot, down $3.90 from Thursday. Net volume was very decent at 172,000 contracts — and there was 48,000 contracts worth of roll-over/switch volume out of August and into future months…mostly December and October, although there continues to be very decent roll-over/activity out into 2021.

|

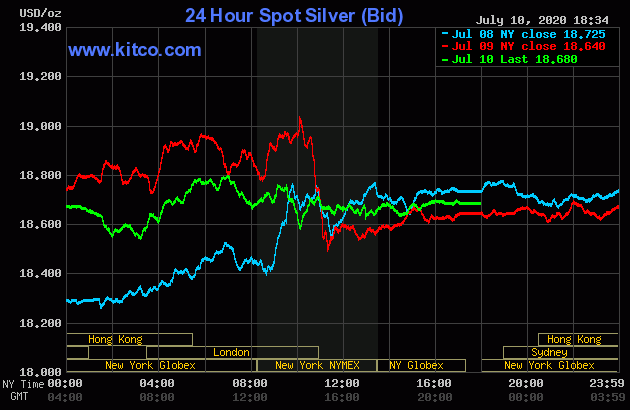

The silver price crept a few pennies higher until shortly before 1 p.m. China Standard Time on their Friday afternoon — and was also sold lower until exactly 2:00 p.m. CST. It also began to head higher starting shortly after the London open — and that lasted until the noon silver fix over there. It was quietly and unevenly down hill from that point until minutes after 10 a.m. in New York. It was only allowed to recover a few pennies from that juncture — and then it didn’t do much for the remainder of the Friday session.

The low and high ticks were reported as $18.91 and $19.195 in the September contract. The August/September price spread differential in silver at the close yesterday was 7.0 cents — and September/December was 17.8 cents.

Silver was closed on Friday afternoon in New York at $18.68 spot, up 4 cents on the day. Net volume was on the heavier side at a bit under 58,000 contracts — and there was about 3,400 contracts worth of roll-over/switch volume on top of that, most of which ended up in December.

|

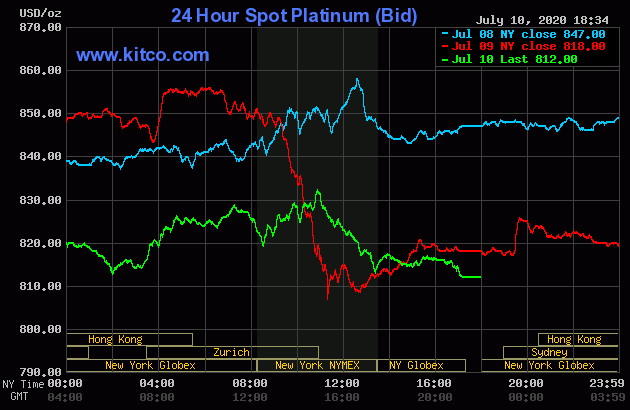

The platinum price jumped up a bit in very early morning trading in the Far East — and then crept lower until shortly before 1 p.m. CST and, like the other three precious metals, was sold down until exactly 2:00 p.m. CST. It headed unevenly higher from there until a few minutes before the 11 a.m. EDT Zurich close — and then was sold quietly lower until the 1:30 p.m. COMEX close. It shed a few more dollars in after-hours trading. Platinum was closed at $812 spot, down 6 dollars on the day — and 32 bucks off its Kitco-recorded high tick of the day.

|

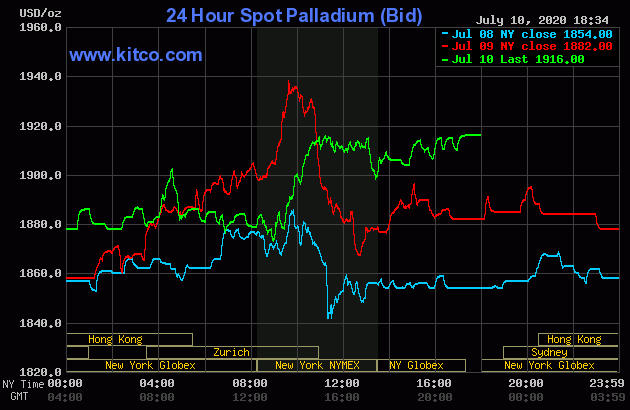

The palladium price jumped quietly around the unchanged mark right up until 9 a.m. in New York. It headed higher from there until it ran into ‘something’ at the 11 a.m. EDT Zurich close — and from there it traded quietly and unevenly sideways until trading ended at 5:00 p.m. EDT. Palladium finished the Friday session at $1,916 spot, up 34 dollars from its close on Thursday — and back above its 200-day moving average.

|

Based on the spot closes in gold and silver on the Kitco charts posted above, the gold/silver ratio worked out to a bit over 96 to 1.

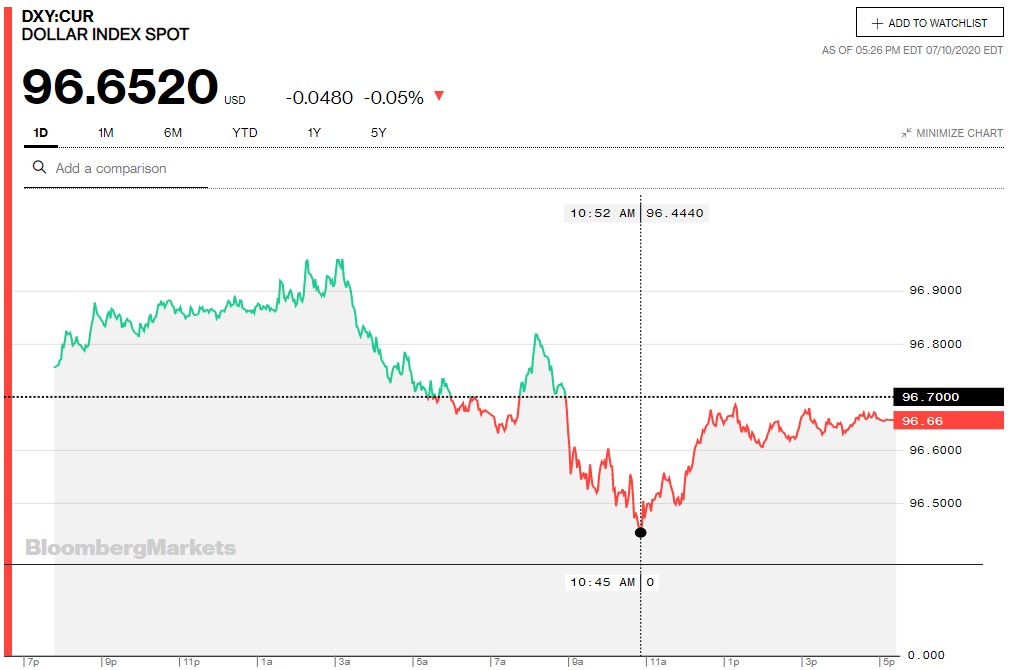

The dollar index was marked-to-close very late on Thursday afternoon in New York at 96.7000 — and opened up precisely 6 basis points at 96.7600 once trading commenced around 7:45 p.m. EDT on Thursday evening, which was 7:45 a.m. China Standard Time on their Friday morning. It began to chop quietly higher immediately — and the 96.974 high tick appeared to be set at 8:12 a.m. BST in London. It was all pretty much down hill from there until the 96.439 low tick was set at 10:52 a.m. in New York. It ‘rallied’ a bit from there until 12:40 p.m. EDT — and then traded quietly sideways until the market closed at 5:30 p.m.

The dollar index finished the Friday trading session at 96.652…down 5 basis points from its close on Thursday.

Here’s the DXY chart for Friday, thanks to Bloomberg. Click to enlarge.

|

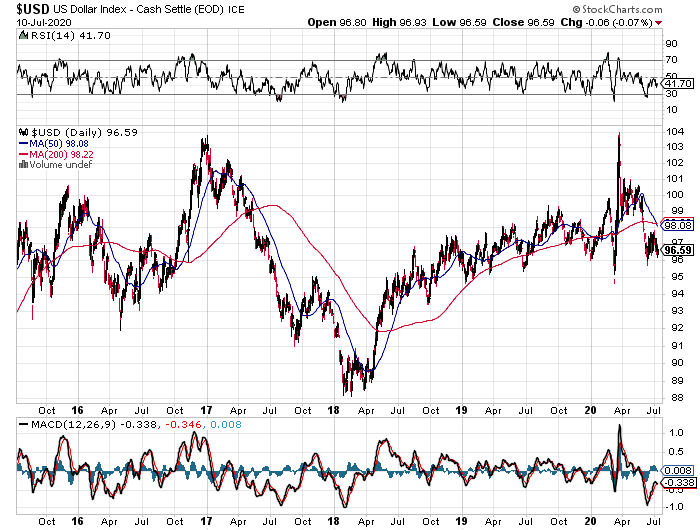

And here’s the 5-year U.S. dollar index chart, courtesy of the folks over at the stockcharts.com Internet site. The delta between its close…96.59…and the close on the DXY chart above was 6 basis points below it spot close on Friday. Click to enlarge as well.

|

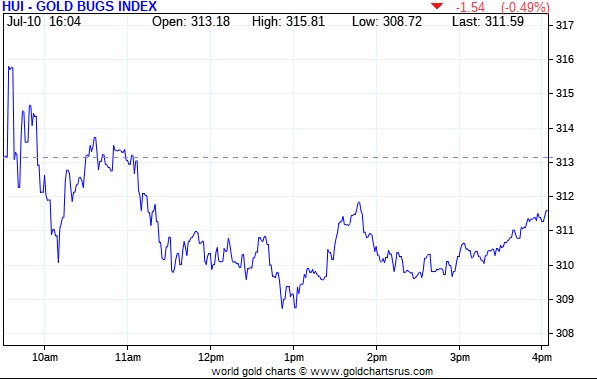

The gold stocks jumped up a bit at the 9:30 a.m. open in New York on Friday morning — and then traded quietly and unevenly lower until 1 p.m. EDT. Then they began to head a bit higher, but weren’t allowed to close in positive territory, as the HUI finished down 0.49 percent on the day.

|

The silver equities chopped impressively higher in a very wide range until they topped out a minute or so before 11 a.m. in New York trading. It was all down hill from there until a few minutes before 1 p.m. EDT — and they then rallied quietly until trading ended at 4:00 p.m. Nick Laird’s Intraday Silver Sentiment/Silver 7 Index closed higher by 1.19 percent. Click to enlarge if necessary.

|

Computing the above index manually showed that it closed up 1.02 percent.

Here’s Nick’s 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday’s doji. Click to enlarge as well.

|

The two stars were Hecla Mining and Peñoles, closing higher by 6.07 and 4.10 percent respectively…the latter on only 400 shares traded. Almost every other component of the Silver 7 Index closed down on the day.

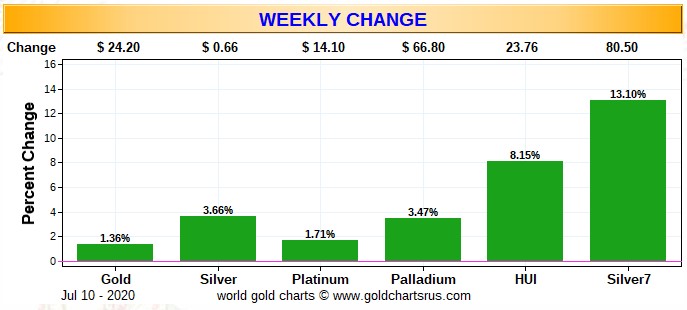

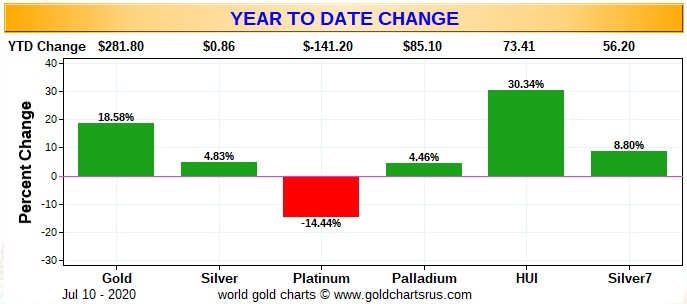

Here are the usual three charts that show up in every Saturday missive. The first one shows the changes in gold, silver, platinum and palladium for the past trading week, in both percent and dollar and cents terms, as of their Friday closes in New York – along with the changes in the HUI and the Silver 7 Index.

Here’s the weekly chart — and it’s a joy to behold for once, with the silver equities outperforming their golden cousins… but not compared to the changes in their respective underlying precious metals. That will change soon enough. Click to enlarge.

|

Here’s the month-to-date chart and, for obvious reasons, it looks very similar to the weekly chart. That’s because the month-to-date chart contains only 2 extra business days compared to the weekly chart above. And as you can tell, the first two days of the month were net down days for everything precious metal related. The big gains were this past week. Click to enlarge.

|

And here’s the year-to-date chart — and gold is still the clear winner so far. But the underperformance of the gold stocks compared to the underlying metal itself, is obvious — and that’s mostly because of what has occurred during June. Silver and its associated shares also had a set-back…but they’ve improved a lot recently — and they’re back in the green once more — and there will be more improvements to come at some point. That applies to gold and its equities as well. Click to enlarge.

|

Although no one is happy about the underperformance of the precious metal equities, it’s my opinion that the worst is behind us — even if we get another engineered price decline in the near or intermediate future.

As per the COT and Days to Cover discussion a bit further down, the Big 8 traders are still mega short gold in the COMEX futures market, but enough has now been brought into the COMEX that they could cover by physical delivery if that becomes necessary. But they still remain trapped in silver, with no obvious way out — and the potential for a JPMorgan double cross of the Big 8 traders is still very much alive.