Europe Bails Out Its Failed States with “Common” (i.e., German) Bonds

by John Rubino, Dollar Collapse:

The “European Project” was designed with something like the current crisis in mind.

The adoption of a common currency was just the first, politically easiest, step in a process that would eventually – its architects hoped – culminate in something like the United States, where a bunch of different geographic and cultural entities are subordinate to a central government that handles war, diplomacy, and finance.

The problem was that pretty much every European country was ambivalent about this transfer of national power to a supranational entity. The weaker countries like Italy feared being dominated by a culturally authoritarian Germany, while the Germans hated the idea of being responsible for spendthrift Italians.

So full integration – which would feature European bonds issued by the entire EU and backed by all the member countries – was put off until a crisis came along to make it the least scary option. And, finally, one arrived in the form of a pandemic that by bankrupting the lesser EU countries made integration necessary to preserve the union.

This week’s EU announcement of a massive coronavirus bailout – featuring the first-ever “common” bond issuance – marks the birth of this new integrated Europe, in which all future debt is de facto German rather than French, Greek, etc.

It also marks the end of any hope that the euro will survive the next decade. Think about it: Italy, Greece, Portugal and the rest no longer have any need to control their spending and borrowing, since Germany is officially on the hook for the EU’s future interest payments.

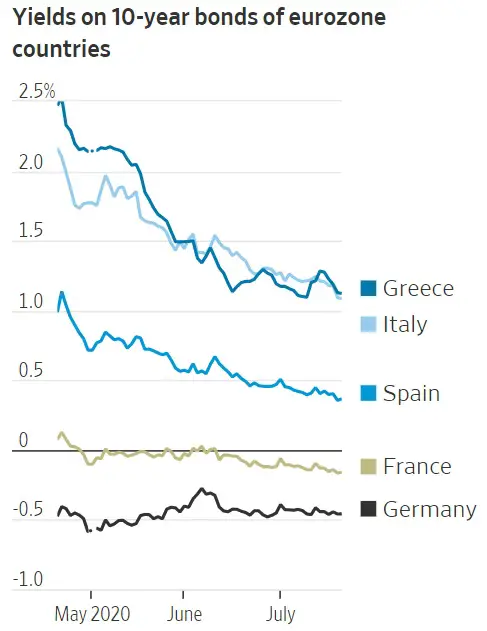

Which in turn means that there can be no future interest payments. The only way to reconcile unconstrained weak-country borrowing with Germany’s ability to manage rising debts is to keep interest rates at least low and preferably negative. Below are the current 10-year bond yields for the major European countries. Note that Germany and France actually get paid to borrow at their current negative rates while the other countries still have to pay their creditors (though only a little).

So in EU 2.0, everyone is free to borrow as much as they want, safe in the knowledge that one way or another the Germans or the European Central Bank will pick up the tab. And interest rates have to remain at unnaturally low levels to make this possible.

Which will produce at least two new crises, either sequentially or concurrently.

In one scenario, Germany tries to impose spending discipline on the more profligate EU countries, which respond with a curt “whatever” and keep on spending — leading an exasperated EU to impose centralized control of individual members’ spending via system-wide social programs and defense budgets.

In the other scenario, negative interest rates lead to either rising inflation or a plunging euro — or more likely both — with all the resulting instability that that implies.

Read More @ DollarCollapse.com