Is Silver on the Brink of a Major Move?

by Marin Katusa, International Man:

There is well-known strategy used in cycling to win races.

Cyclists ride in a peloton formation to conserve energy by drafting behind lead riders.

The cyclists take turns being in the front and using most of the energy. For the riders behind the leader, this results in a reduction in air resistance – drag.

In a race where winners and losers are separated by seconds, this strategy can reduce drag by 5-10%.

Stretch that reduction over hundreds of miles and the amount of energy saved adds up – in a big way. This allows riders to sprint to the front with more energy.

Right now, it feels very much like gold is leading the precious metals pack at the front of the peloton.

Could silver be conserving its energy looking to make a sprint to the front of the pack?

Let’s Start with Silver 101

Silver (or ‘Argentum’ in Latin) has been a prized metal since antiquity.

Though too brittle to forge swords or armor, its luster and rarity made it a prized medium of exchange.

Powerful empires like Ancient Rome to Imperial Spain couldn’t mine enough of it.

Silver coins became the unit of account in many important currencies: the Greek Drachma; the Roman Denarius, the Islamic Dirham and the Spanish dólar.

Here is an interesting fact for all the silver bugs out there…

It was the Spanish dólar, with its standardized dimensions, that inspired Treasury Secretary Alexander Hamilton to adopt the US Dollar as the currency of the newly-founded United States of America.

Now, Silver has one thing that gold does not – affordability and abundance.

Over 60% of silver is used in industrial applications, with the residual sub 40% used in jewelry and silver bullion. There’s certainly an argument to be made that silver is a base metal that likes to pretend that it’s still precious.

Production and Pricing

One of the most important things to understand about any commodity is its supply and demand fundamentals.

Silver production has been impacted severely by COVID-19.

As much as 66% of primary silver mine production was put on hold for about two to four weeks

Over 101 mines are still affected as of June 18, 2020. This represents about 33.52M oz. of total production at risk, and amounts to 26% of the 2020 mine production.

A second round of lockdowns would be good for the price of the silver, at least on the supply side. It’s bad news for miners who have to shut in or curb production.

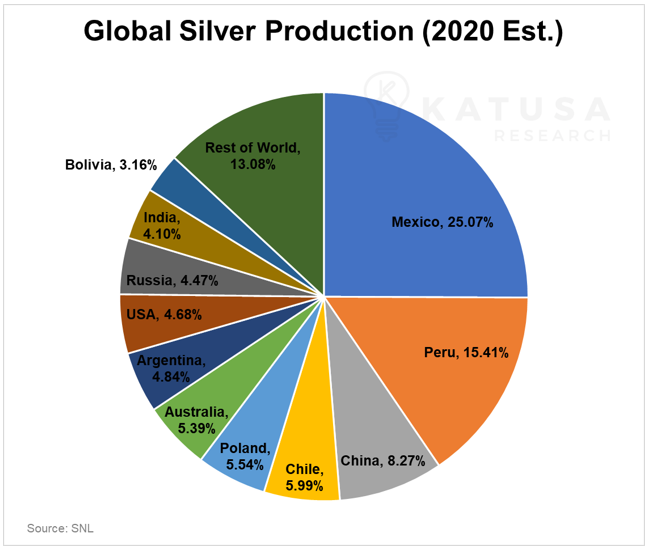

What Are the Largest Silver Producing Countries?

Over 60% of primary silver production comes from Latin America, or Silver CAMP: Chile, Argentina, Mexico and Peru.

And let’s not forget Guatemala will become a major producer once my buddy Ross Beaty starts up the Escobal silver mine. It truly is one of the world’s most attractive primary silver mines.

Many of those countries are facing a resurgence of the Coronavirus.

All these countries have eventually classified mining as an essential service. But, a serious outbreak on a mine site could result in closures.

Below is a chart showing the estimated global silver production for this year.

Note that these production estimates were made pre-COVID-19.

In fact, many of the largest silver miners, including Fresnillo, Buenaventura and Pan American Silver have withdrawn their production guidance for 2020.

Normally, production deficits are beneficial for prices. However, the fact that 75% of silver’s demand is used for industrial and commercial purposes is likely crippling its safe haven demand.

This is one of the reasons why silver hasn’t been performing as well as gold or US Treasuries to date.

But there’s another reason why most portfolio managers won’t put ‘silver’ in the same category as US Treasuries, Japanese Govt Bonds, US Dollars and Gold…

That’s because, it’s simply too volatile to act as a hedge.

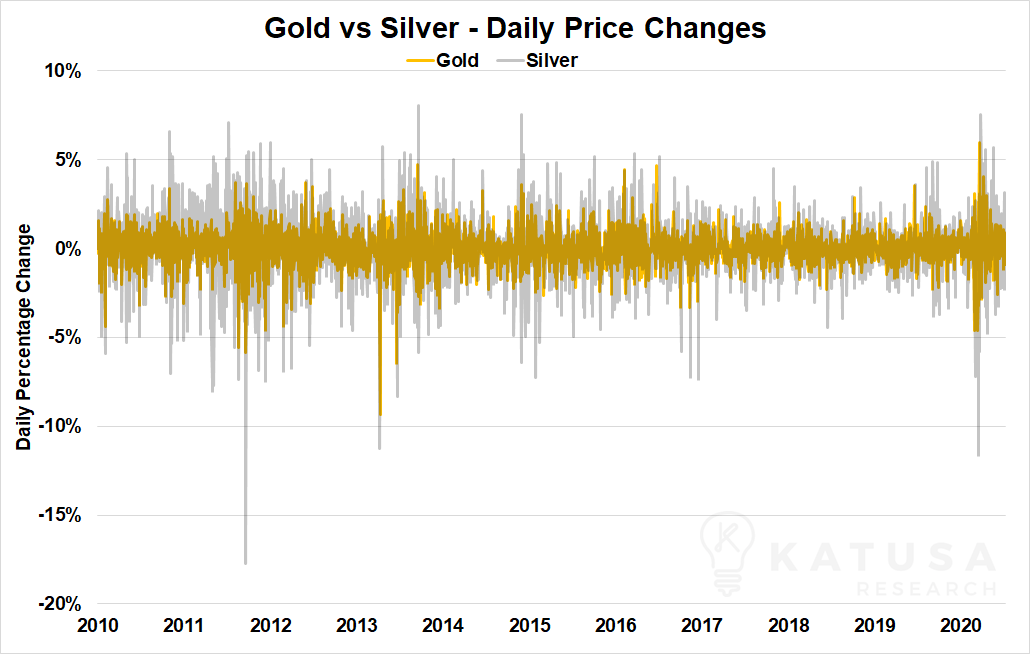

For this, we can instead look at the magnitude of daily price changes (positive and negative) for both assets.

In the next chart, you can see the volatility of silver prices. Over the last 10 years, it had much higher daily percentage gains and losses than gold did.

Do Central Banks Hoard Silver?

In short, the answer is no. Sorry Silver Bugs.

Central banks don’t deem it stable or valuable enough to hold as foreign reserves.

Also, the value of reserves per square foot in the vault is vastly inefficient when compared to gold.

Up to 47% of annual gold demand is for investments – including central bank foreign exchange reserves.

Gold Demand vs. Silver Demand

Gold prices are primarily determined by its demand as an investment (store of value).

On the other hand, silver prices are as much determined by industrial and commercial users than by investors.

Read More @ InternationalMan.com