Bank Of America: Fed Will Use Digital Dollars To Unleash Inflation, UBI & Debt Forgiveness

by Tim Brown, DC Clothesline:

On The Sons of Liberty morning show on Saturday, i spoke about debt, usury and the Federal Reserve and here’s a perfect example of how not following the Word of God pans out for the people as the bankers are set to usher in the New World Order and digital currency which will not only track every thing you do but will also lock you out of being able to buy or sell (Rev. 13:17) if you don’t comply. Now, Bank of America is supplying the “solution” to the entire thing, something that the Great Reset promises as well.

TRUTH LIVES on at https://sgtreport.tv/

Tyler Durden has the story:

When we recently described the upcoming “Unprecedented monetary overhaul” which will come in the form of the Fed sending out digital dollars directly to “each American”, we explained that:

ABSENT A MASSIVE BURST OF INFLATION IN THE COMING YEARS WHICH INFLATES AWAY THE HUNDREDS OF TRILLIONS IN FEDERAL DEBT, THE DEBT TSUNAMI THAT IS COMING WOULD MEAN THE END TO THE AMERICAN WAY OF LIFE AS WE KNOW IT. AND TO DO THAT, THE FED IS NOW FINALIZING THE LAST STEPS OF A PROCESS THAT REVOLUTIONIZES THE ENTIRE FIAT MONETARY SYSTEM, LAUNCHING DIGITAL DOLLARS WHICH EFFECTIVELY REMOVE COMMERCIAL BANKS AS FINANCIAL INTERMEDIARIES, AS THEY WILL ALLOW THE FED ITSELF TO MAKE DIRECT DEPOSITS INTO AMERICANS’ “DIGITAL WALLETS”, IN THE PROCESS ENABLING TRULY UNIVERSAL BASIC INCOME, WHILE ALSO MAKING CONGRESS AND THE ENTIRE LEGISLATIVE BRANCH REDUNDANT, AS A HANDFUL OF TECHNOCRATS QUIETLY TAKE OVER THE UNITED STATES.

In short, we laid out the Fed’s true reasoning behind the coming Digital Dollars not as how Fed Chair Powell recently described them, which as a reminder was as follows:

- Faster and cheaper transactions

- Addressing a decline in the use of physical currency

- Modernizing the payments infrastructure

- Reaching consumers who have been traditionally underserved by financial institutions

… but as a short circuit to a clearly broken monetary transmission mechanism, one which seeks to facilitate universal basic income and unlimited helicopter money, by completely overhauling how money reaches Americans.

Of course, it would be heresy to admit that the Fed’s true motive is to effectively spark runaway inflation as that would provoke howls of outrage from ordinary Americans if they only learned that the $1000 or so in “free money” they would receive from the Fed was not a gift, but a curse which would make their cost of living unbearable in very short notice. And yet none other than DoubleLine recently penned a scathing op-ed admitting just that, warning that “The Pandora’s Box Of Fed’s Digital Currency Will Ignite An Inflationary Conflagration.”

Today, none other than BofA chief investment strategist also takes the plunge into “tinfoil land”, which of course is where the truth can be found, and admits the truth about digital currencies.

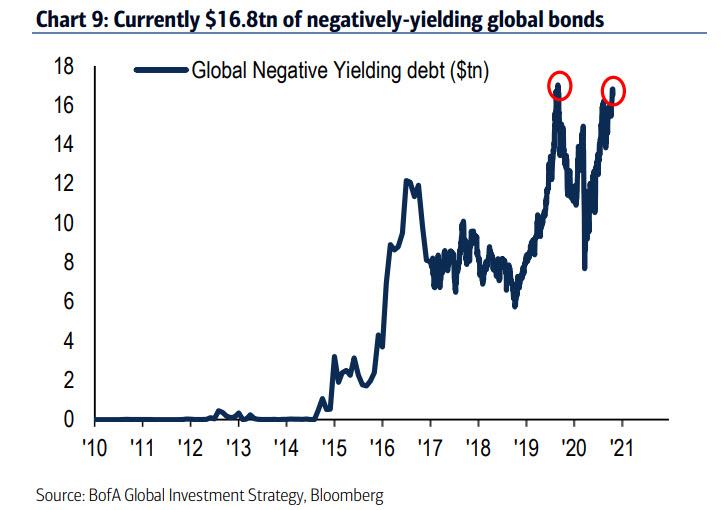

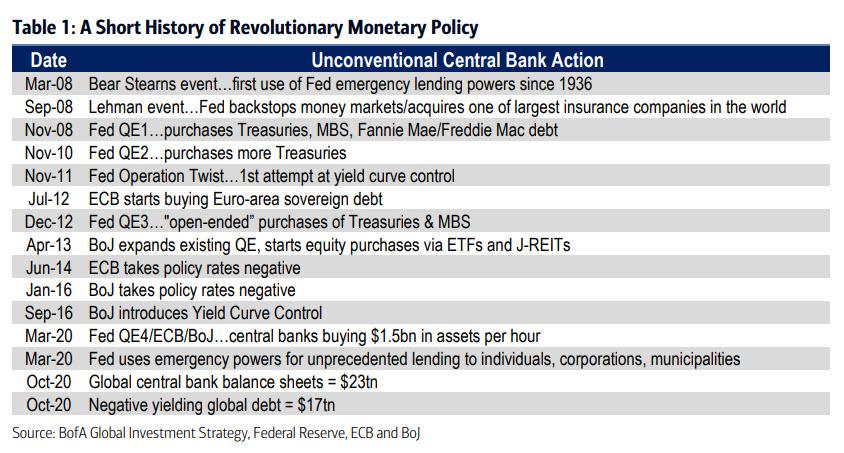

Hartnett begins by laying out a short history of revolutionary monetary policies, writing that in the past 13 years central banks have cut interest rates 972 times, bought $19tn of financial assets via QE, introduced NIRP, ZIRP, YCC, TLTROs, resulting in a near-record $16.8tn of negatively-yielding global bonds.

Hartnett lays out the 15 key “revolutionary” events in monetary policy since the Bear Stearns collapse in the table below:

Here Hartnett echoes everything we have said recently on the matter, and there’s quite a bit of it…