Consumers Expect Surging Inflation to Crush the Purchasing Power of their Labor: Fed’s Survey

by Wolf Richter, Wolf Street:

And there are some whoppers.

And there are some whoppers.

Consumers are picking up on the rise of inflation, and the Fed, which has been trying to heat up inflation, is pleased. The Fed watches “inflation expectations” carefully. The minutes from the March FOMC meeting mention “inflation expectations” 12 times.

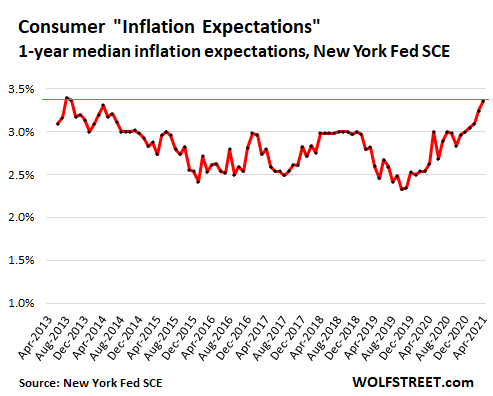

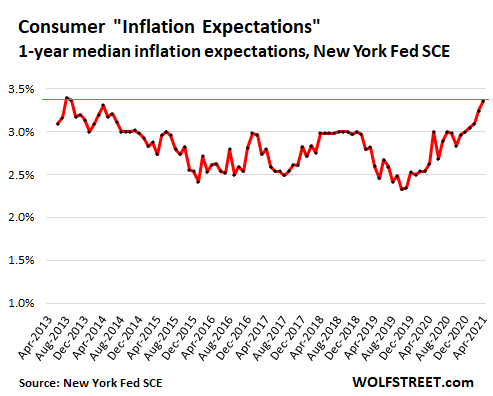

The New York Fed’s Survey of Consumer Expectations for April, released today, showed that median inflation expectations for one year from now rose to 3.4%, matching the prior highs in 2013 (the surveys began in June 2013).

TRUTH LIVES on at https://sgtreport.tv/

But wait… the median earnings growth expectations 12 months from now was only 2.1%, and remains near the low end of the spectrum, a sign that consumers are grappling with consumer price inflation outrunning earnings growth. The whoppers were in the major specific categories.

The whoppers.

So even as consumers expect their earnings to grow by only 2.1% over the next 12 months, and their total household income by only 2.4%, according to the survey, they expect to face these whoppers of price increases:

- Home prices: + 5.5%, a new high in the data series

- Rent: + 9.5%, fifth month in a row of increases and new high in the data series

- Food prices: + 5.8%

- Gasoline prices: + 9.2%

- Healthcare costs: + 9.1%

- College education: + 5.9%.

Sadly, the Fed doesn’t ask consumers about their expectations for new and used vehicle prices, which are now in the process of spiraling into the stratosphere. It would have been amusing to see what consumers expect those prices to do over the next 12 months.

So consumers expect to pay for these price increases with their earnings that they expect to increase at only a fraction of those price increases. In other words, consumers expect that the purchasing power of their labor will be crushed over the next 12 months.

Higher inflation expectations are associated with consumers being more willing to pay for price increases, rather than go on buyers’ strike. And by not going on buyers’ strike when prices rise, they allow companies to jack up prices, and thereby they allow inflation to run higher, in theory at least, and that is why the Fed is watching inflation expectations so carefully. In theory, they open the door to actual inflation.