Druckenmiller: “There’s Been No Greater Engine Of Inequality Than The Fed”

from ZeroHedge:

After his status-quo-shattering appearance on CNBC this week, during which he warned that “Fed policy is endangering the dollar’s reserve status,” billionaire fund manager Stan Druckenmiller spoke to The USC Marshall Center for Investment Studies’ Student Investment Fund Annual Meeting via Zoom, and shocked the on-lookers with his frank assessment of our current perceptions and realities.

After his status-quo-shattering appearance on CNBC this week, during which he warned that “Fed policy is endangering the dollar’s reserve status,” billionaire fund manager Stan Druckenmiller spoke to The USC Marshall Center for Investment Studies’ Student Investment Fund Annual Meeting via Zoom, and shocked the on-lookers with his frank assessment of our current perceptions and realities.

TRUTH LIVES on at https://sgtreport.tv/

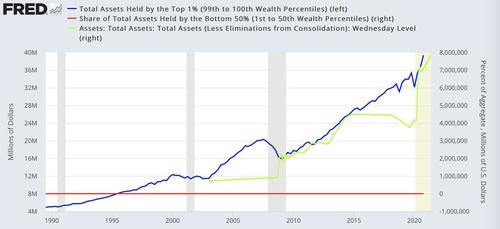

After The Bank of Canada sheepishly admitted this week that “some of the monetary policy tools it is using to address the COVID-19 pandemic, such as quantitative easing (QE), could widen wealth inequality,” Druckenmiller drops the proverbial hammer on all the hedged-speak (“could”), and blasts that

“I don’t think there has been a greater engine of inequality than the Federal Reserve Bank of the United States… so hearing the Chairman [Powell] talking about visiting homeless shelters is very rich indeed…”

The outspoken fund manager went on to note that “everyone wealthy that I know is making fortunes” because “this guy [Powell] is printing money like there’s no tomorrow” adding that the kids is Harlem are not benefitting from money-printing but wealthy people are, exclaiming that

“…for the life of me I can’t understand why the left is so excited about money-printing when all the data shows that the people who benefit from money-printing are rich people.”

“The odds-on bet is that we’re going to have inflation,” he continues:

“and inflation is going to hurt poor people, again, a lot more than rich people.”

How does this all end?

“The asset bubble which [Powell] is blowing up into unbelievable proportions busts before the inflation ever really manifests itself, that’s what happened in the housing bubble in 08/09. We never really got to the inflation because the asset bubble burst… not dis-similar to what happened in 1929.”

And Druck reminds us all, “there is no one, no group, that will be hurt more by a bust than the poor… they will be first in line to get screwed.”

“I don’t think there’s been any greater engine of inequality than the Federal Reserve Bank of the United States the last 11 years.”

– Stan Druckenmiller

cc @federalreserve @neelkashkari @NewYorkFed https://t.co/hP78xlcyBh

— Rudy Havenstein, Gain-Of-Function Fintwit. (@RudyHavenstein) May 16, 2021

Can’t believe it’s true? Take a look…

While publicly glorified by the media as “heroes” and “saviors” of the economy, Sven Henrich pointed out earlier that the true impact of Fed policy is much more sinister.

Inflation, as Druckenmiller rightly points out hurts the poor the most as living expenses take up most if not all of their monthly budgets.

Watch the full Druckenmiller discussion here.

This revelation to some (not all) came after his earlier-in-the week, WSJ Op-Ed that “keeping emergency settings after the emergency has passed carries bigger risks for the Fed than missing its inflation target by a few decimal points. It’s time for a change.”

Pointing out, rather awkwardly that The Fed’s independence is supposed to act as a counterbalance to these political whims.

“America’s deep divisions also make the central bank’s independence crucial. Fighting inequality and climate change are very far from the Fed’s central mission.”

The long-term risks from asset bubbles and fiscal dominance dwarf the short-term risk of putting the brakes on a booming economy in 2022.