Who Bought the $4.7 Trillion of Treasury Securities Added Since March 2020 to the Incredibly Spiking US National Debt?

by Wolf Richter, Wolf Street:

The Fed did. Nearly everyone did. Even China nibbled again. Here’s who holds that monstrous $28.1 trillion US National Debt.

The Fed did. Nearly everyone did. Even China nibbled again. Here’s who holds that monstrous $28.1 trillion US National Debt.

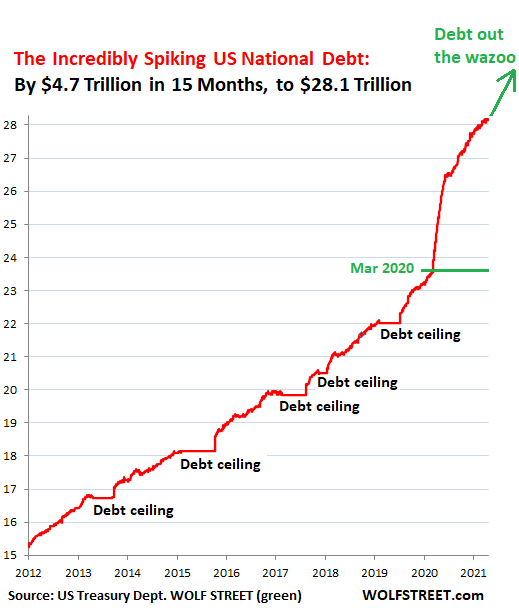

The US national debt has been decades in the making, was then further fired up when the tax cuts took effect in 2018 during the Good Times. But starting in March 2020, it became the Incredibly Spiking US National Debt. Since that moment 15 months ago, it spiked by $4.7 trillion, to $28.14 trillion, amounting to 128% of GDP in current dollars:

TRUTH LIVES on at https://sgtreport.tv/

But who bought this $4.7 trillion in new debt?

We can piece this together through the first quarter in terms of the categories of holders: Foreign buyers as per the Treasury International Capital data, released this afternoon by the Treasury Department; the purchases by the Fed as per its weekly balance sheet; the purchases by the US banks as per the Federal Reserve Board of Governors bank balance-sheet data; and the purchases by US government entities, such as US government pension funds, as per the Treasury Department’s data on Treasury securities.

Foreign creditors of the US.

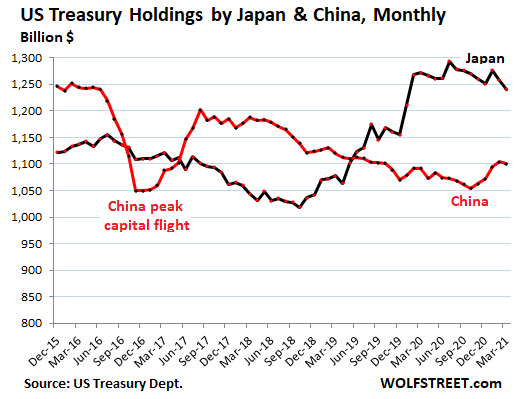

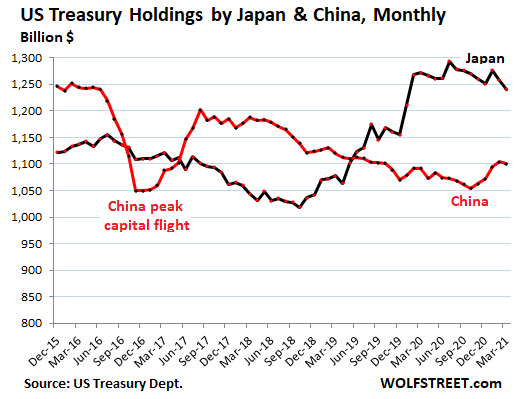

Japan, the largest foreign creditor of the US, dumped $18 billion of US Treasuries in March, reducing them to $1.24 trillion. Since March 2020, its holdings dropped by $32 billion.

China had been gradually reducing its holdings over the past few years, but then late last year started adding to them again. In March, it purchased a not of $4 billion, bringing its holdings to $1.1 trillion, Since March 2020, it added $9 billion:

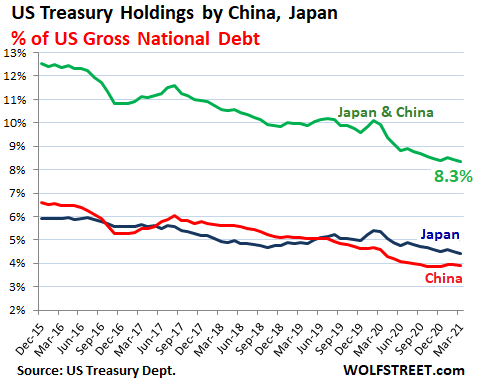

But Japan’s and China’s importance as creditors to the US has been diminishing because the US debt has ballooned. In March, their combined share (green line) fell to 8.3%, the lowest in many years:

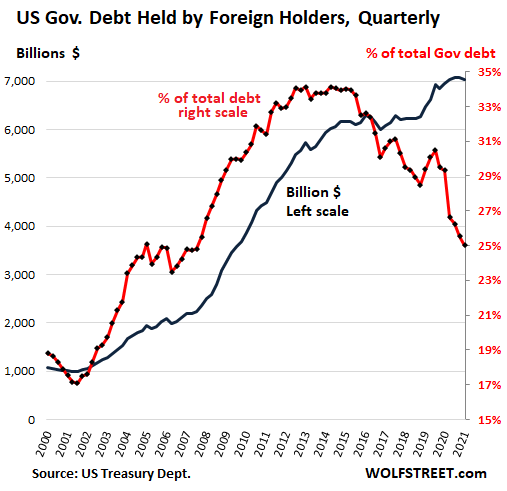

All foreign holders combined dumped $70 billion in Treasury securities in March, bringing their holdings to $7.028 trillion (blue line, left scale). But this was still up by $79 billion from March 2020.

These foreign holders include foreign central banks, foreign government entities, and foreign private-sector entities such as companies, banks, bond funds, and individuals. Despite the increase of their holdings since March 2020, their share of the Incredibly Spiking US National Debt fell to 25.0%, the lowest since 2007 (red line, right scale):

After Japan & China, the 10 biggest foreign holders include tax havens where US corporations have mailbox entities where some of their Treasury holdings are registered. But Germany and Mexico, with which the US has massive trade deficits, are in 17th and 24th place. The percentages indicate the change from March 2020. Note the percentage increase of India’s holdings:

- UK (“City of London” financial center): $443 billion, -5.6%

- Ireland: $309 billion, + 13.8%

- Luxembourg: $283 billion, + 14.8%

- Brazil: $255 billion, -3.4%

- Switzerland: $255 billion; + 4.2%

- Belgium: $236 billion, + 14.4%

- Taiwan: $232 billion, + 12.9%

- Hong Kong: $227 billion, -11.3%

- Cayman Islands: $215 billion, + 2.8%

- India: $200 billion, + 27.8%.

US government funds hit record, but share of total debt drops further.

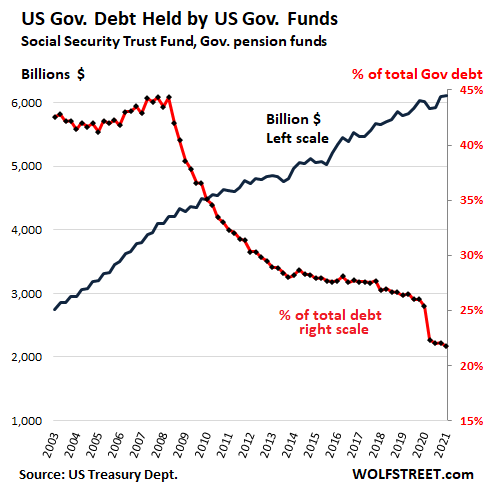

US government pension funds for federal civilian employees, pension funds for the US military, the US Social Security Trust Fund, and other federal government funds bought on net $5 billion of Treasury securities in Q1 and $98 billion since March 2020, bringing their holdings to a record of $6.11 trillion (blue line, left scale).

But that increase was outrun by the Incredibly Spiking US National Debt, and their share of total US debt dropped to 21.8%, the lowest since dirt was young, and down from a share of 45% in 2008 (red line, right scale):

Federal Reserve goes hog-wild: monetization of the US debt.

The Fed bought on net $243 billion of Treasury securities in Q1 and $2.44 trillion since it began the bailouts of the financial markets in March 2020. Over this period through March 31, it has more than doubled its holdings of Treasuries to $4.94 trillion (blue line, left scale). It now holds a record of 17.6% of the Incredibly Spiking US National Debt (red line, right scale):