Peak Mined Silver Reached

from SilverSeek:

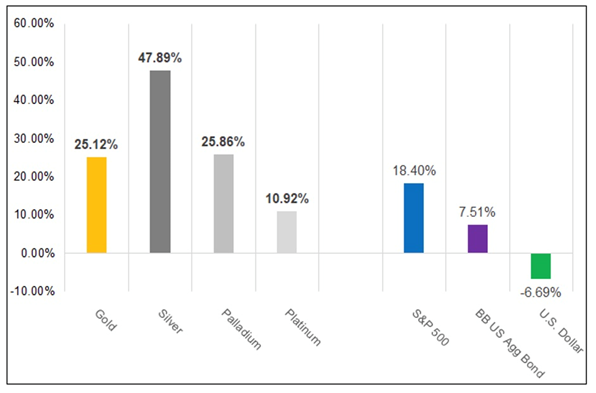

Spot silver jumped to $28.32 an ounce in August 2020, its best performance in seven years, and though the price retreated last fall, it finished the year up an impressive 47%, more than doubling gold’s 22% gain.

Spot silver jumped to $28.32 an ounce in August 2020, its best performance in seven years, and though the price retreated last fall, it finished the year up an impressive 47%, more than doubling gold’s 22% gain.

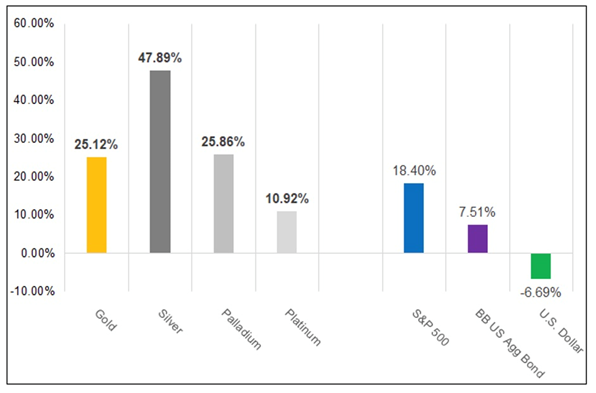

In late January silver kicked higher after a Reddit WallStreetBets subpost triggered a call to buy. A flurry of purchases saw silver blow past $28 and touch $31 briefly, before falling back. Since March, the white metal has been trading in a fairly tight range between $26 and $28.

TRUTH LIVES on at https://sgtreport.tv/

Year to date spot silver. Source: Kitco

Year to date spot silver. Source: Kitco

However, the silver outlook is extremely positive due to a combination of strong monetary and industrial demand drivers.

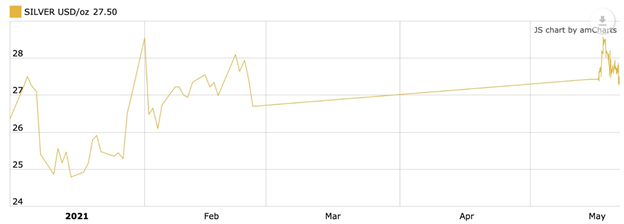

According to the 2021 World Silver Survey, by The Silver Institute, global demand for silver this year is expected to outpace supply by 7% (+ 8% supply vs + 15% demand).

Global demand will be led by investments in industrial and investment-grade physical silver, as a result of economic recovery from the pandemic, as well as healthy coin and bar purchases building on 2020’s gains.

The Silver Institute therefore expects the silver price to advance a whopping 33% in 2021.

In fact we can take the positive silver narrative further, by analyzing supply and demand. In doing so, we feel confident in calling peak mined silver.

Peak mined silver

The concept of a peak resource should be familiar to most readers and investors. It refers to the point when production is no longer growing, year after year. It reaches a peak, then declines.

Notice we didn’t say “peak silver”. At AOTH we differentiate between the total silver supply, which lumps in recycled silver with mined silver, versus mine supply on its own.

In calculating the true picture of silver demand versus supply, we don’t count silver recycling (most recycled silver is industrial grade). What we want to know, and all we really care about, is whether the annual supply of mined silver meets annual demand for silver. It doesn’t!

To illustrate:

In 2020 mined silver slumped the most in a decade, owing to a number of coronavirus-related mine closures in Latin America where the majority of silver is produced. It fell 5.9% to 784.4 million ounces, according to the 2021 World Silver Survey.

However, as a result of higher silver prices in the second half of the year, global silver recycling rose by 7%, hitting a 7-year high of 182.1Moz. Scrap generated from industrial end uses also climbed higher last year.

Combined, therefore, we have total silver supply reaching 966.5Moz in 2020.

How about demand? According to the World Silver Survey, after rising for two years, in 2020 silver demand weakened by 10%, with most of the losses attributed to a fall in industrial demand, resulting from the pandemic.

(Remember: While most of the mined gold is still around, either cast as jewelry, or smelted into bullion and stored for investment purposes, the same cannot be said for silver. It’s estimated around 60% of silver is utilized in industrial applications, like solar panels and electronics, leaving only 40% for investing.)

Industrial fabrication slumped to a five-year low in 2020, leaving total silver demand at 896.1Moz.

No peak silver here, right? Demand of 896.1Moz is more than satisfied by supply of 966.5Moz.

But when we strip recycling out of the equation, 182.1Moz, we get an entirely different result. ie. 896.1Moz of demand minus 784.4Moz mine supply leaves a deficit of 111.7Moz.

This is significant, because it’s saying even though industrial demand for silver, which makes up about 60% of usage, got slammed last year due to the pandemic, the total demand, industrial plus investment, was greater than mine supply (which admittedly had a bad year due to shutdowns) by about 100Moz.

Only by recycling 182.1Moz could silver demand be satisfied in 2020.

This is our definition of peak mined silver. Will the silver mining industry be able to produce, or discover, enough silver that it’s able to meet demand without having to recycle? If the numbers reflect that, peak mined silver would be debunked. It didn’t happen in 2020, and according to the Silver Institute, it won’t happen in 2021 either.

Again, let’s look at the numbers.

With silver mines returning to full capacity, the Silver Institute expects silver output to rebound from last year’s doldrums, rising 8.2% year on year to 848.5Moz. The biggest increase will be from countries most heavily impacted by the pandemic, such as Mexico, Peru and Bolivia.

The Silver Institute predicts total supply will increase 8% to 1,056.3Moz, but again, this includes recycling. Taking 196.2Moz of forecasted recycling out of the equation, we have mined supply of 848.5Moz against the Silver Institute’s 2021 demand forecast of 1,154.3Moz, leaving another forecasted deficit, and one that is larger than 2020’s, of 305.8Moz.

(total demand includes industrial fabrication rising to an 8-year high of 524Moz + jewelry fabrication of 184.4Moz + silverware 43.1Moz + bars and coins 252.8Moz + silver ETFs 150Moz = 1,154.3Moz)

Raucous demand

In fact the Silver Institute’s demand figure is quite conservative. We expect it to be much higher, given that the loose monetary policy of the US Federal Reserve and other central banks is likely to continue, keeping bond yields/ interest rates low, resulting in strong uptake for precious metals; and the numerous industrial applications for silver, stemming from silver’s high conductivity, which appear to be growing in leaps and bounds particularly those pertaining to “green” technologies and 5G.