US Mint Delays Silver Shipments Due To “Global Silver Shortage”

from ZeroHedge:

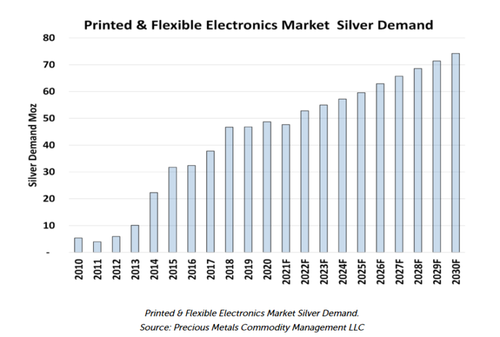

Interest in silver is soaring (both for industrial use and financial investment), echoing 2013’s crisis, as a recent report from the Silver Institute, silver demand for printed and flexible electronics is forecast to increase 54% over the next 10 years.

Demand for silver in this rapidly developing sector is forecast to come in at 48 million ounces this year. By 2030, the demand is expected to surge to 615 million ounces.

TRUTH LIVES on at https://sgtreport.tv/

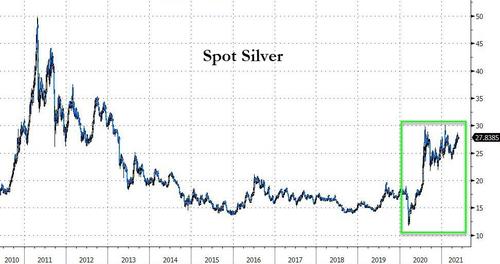

And silver prices are back near recent highs as monetizing debt

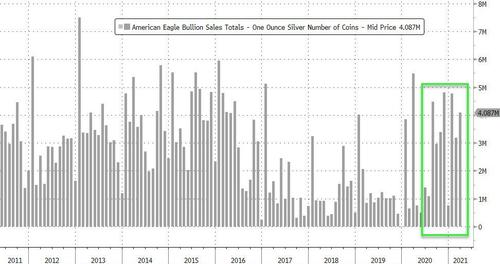

And according to the New York Times, the U.S. Mint even upped its coin production in mid-2020 after shortages of coins have been reported in the U.S. as a result of the coronavirus pandemic, but demand over the past few months from coin hodlers appears to have overwhelmed the US Mint.

As they just warned that they are halting sales due to a global silver shortage leaving them unable to meet orders…

The full statement from the US Mint (via Facebook):

The United States Mint is committed to providing the best possible online experience to its customers.

The global silver shortage has driven demand for many of our bullion and numismatic products to record heights. This level of demand is felt most acutely by the Mint during the initial product release of numismatic items. Most recently in the pre-order window for 2021 Morgan Dollar with Carson City privy mark (21XC) and New Orleans privy mark (21XD), the extraordinary volume of web traffic caused significant numbers of Mint customers to experience website anomalies that resulted in their inability to complete transactions.

In the interest of properly rectifying the situation, the Mint is postponing the pre-order windows for the remaining 2021 Morgan and Peace silver dollars that were originally scheduled for June 1 (Morgan Dollars struck at Denver (21XG) and San Francisco (21XF)) and June 7 (Morgan Dollar struck at Philadelphia (21XE) and the Peace Dollar (21XH)).

While inconvenient to many, this deliberate delay will give the Mint the time necessary to obtain web traffic management tools to enhance the user experience. As the demand for silver remains greater than the supply, the reality is such that not everyone will be able to purchase a coin. However, we are confident that during the postponement, we will be able to greatly improve on our ability to deliver the utmost positive U.S. Mint experience that our customers deserve. We will announce revised pre-order launch dates as soon as possible.

For now, according to generic data from Bloomberg, the physical premium over paper prices has somewhat normalized…