China Gold-Buying Frenzy Sparks Chaos In ETFs

from ZeroHedge:

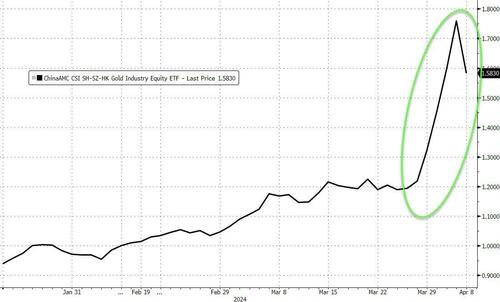

For the second time in a week, trading in an ETF that owns gold companies was halted in China overnight.

The ETF’s price had gained over 40% in the past four sessions before falling 10% after trading resumed Monday.

“The lack of alternatives, and the fact that it’s become a lot more difficult than it was a few years ago to get your money out of China and invest elsewhere – I think that’s definitely helping gold,” said Nikos Kavalis, managing director at consultancy Metals Focus Ltd.

“Demand is pretty decent, considering where the price is.”

TRUTH LIVES on at https://sgtreport.tv/

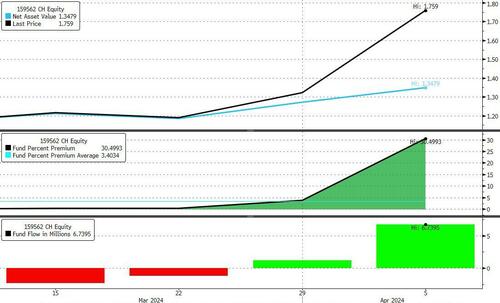

China Asset Management Co. – who run the ChinaAMC CSI SH-SZ-HK Gold Industry Equity ETF – halted the investment vehicle “to protect investors’ interests” as the fund’s premium over its underlying assets increased to more than 30%…

As Bloomberg’s Eric Balchunas highlighted: “Investors [in China] are so desperate to buy things that are not linked to their own economy/stock mkt, which has been in the gutter.”

For context, that surge in the ETF correlated with a spot gold price near $2700…

Source: Bloomberg

As Bloomberg reports, the enthusiasm about products tied to gold, which has staged a record-setting rally in recent weeks, shows a desire to park money in a sector seen relatively immune to a struggling economy.

“Gold is trading at an all time high and gold ETF demand has surged in the past week with almost $600 million of net inflows into gold ETFs globally,” said Rebecca Sin, a Bloomberg Intelligence analyst.

“Demand in Mainland China could continue as investors look to diversify their holdings with commodities and foreign ETFs.”

The ETF fervor is a fresh example of yield-hungry Chinese investors flocking to pockets of market strength as deepening property woes, volatile stocks and falling deposit rates reduce their options.