First-Time Buyers Must Earn $120,000 To Afford The Average Home

By Tyler Durden

By Tyler Durden

Earlier today we reported that for at least 40% of Americans – up from 27% just two years ago – the American Dream is dead and buried and has been replaced with the American nightmare: renting for life.

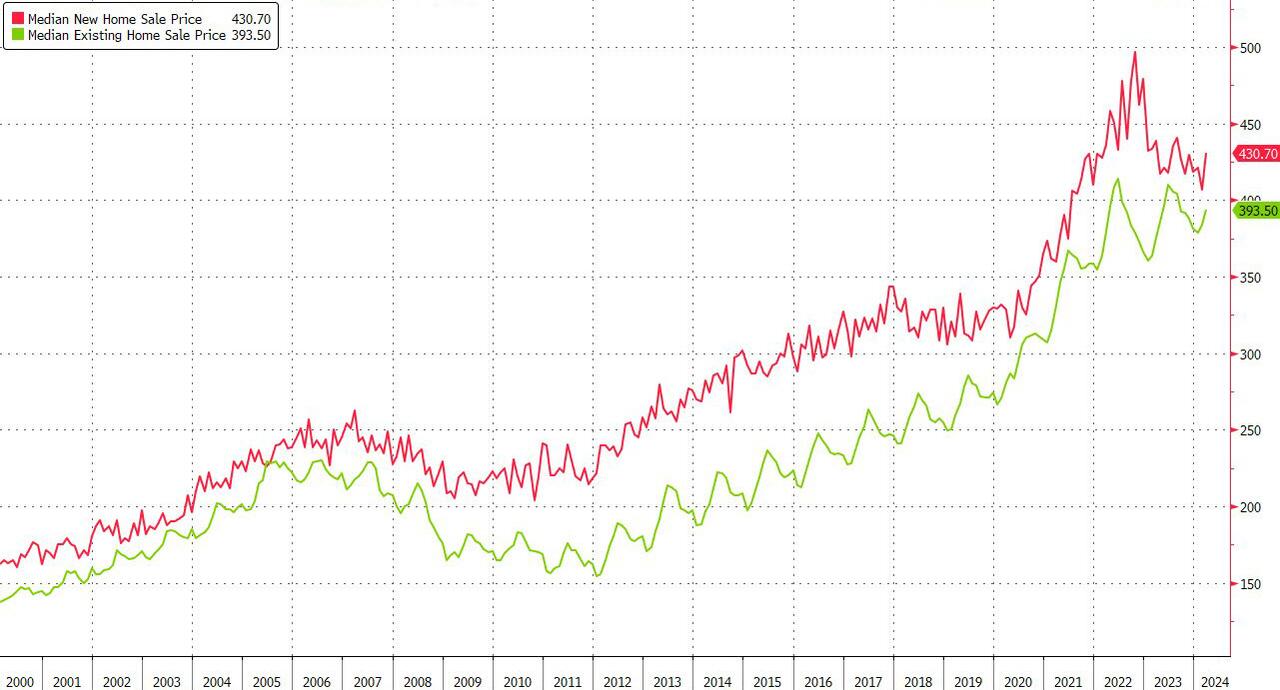

And here’s why: according to a new survey from Clever Real Estate, a St. Louis-based real estate company, thanks to the galloping housing inflation, the median-priced home in the U.S. now costs $332,494, with NAR and Census Bureau data reporting that the median Existing and New Home sale price has risen to $393,500 and $430,700…

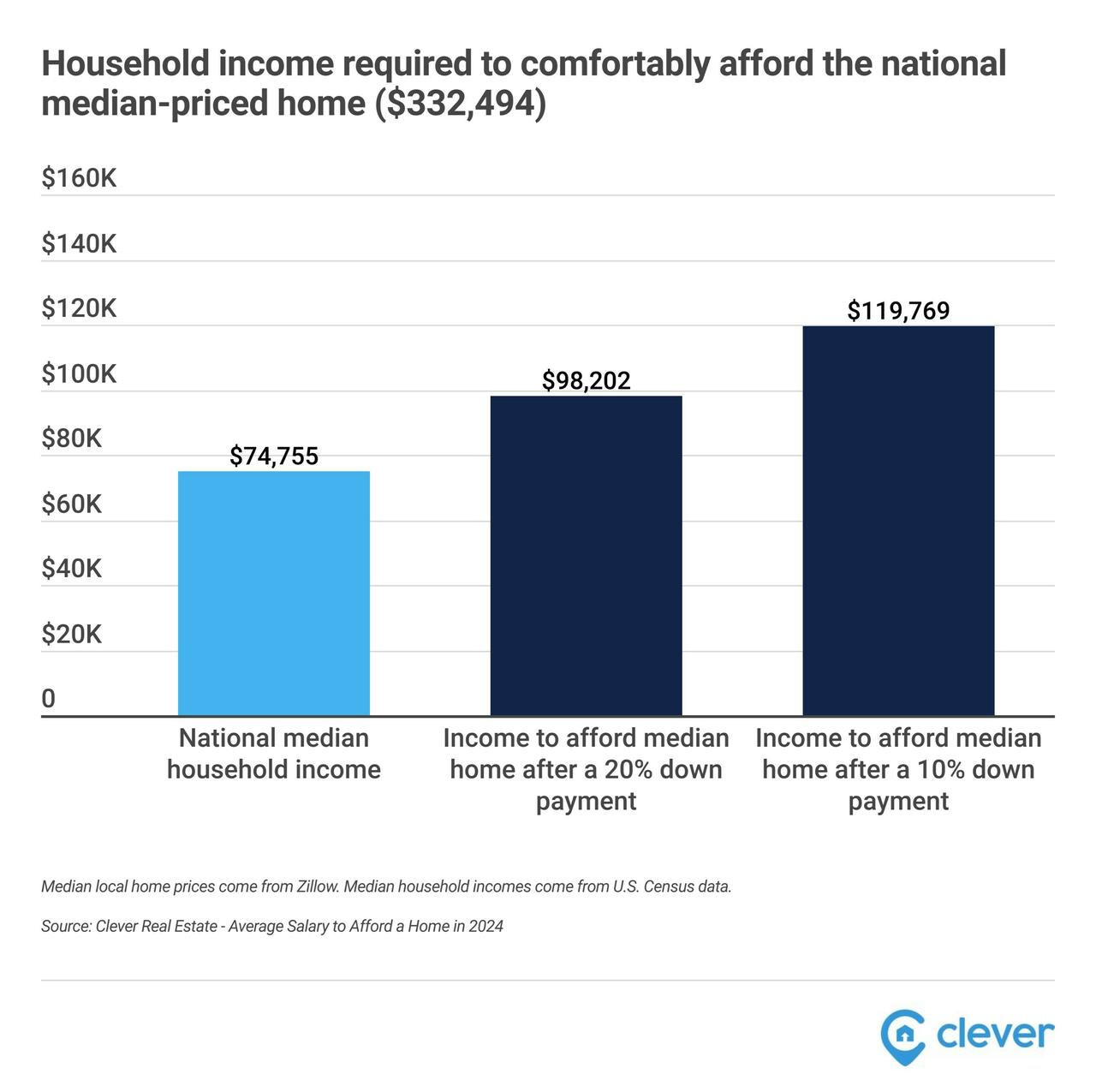

… meaning prospective buyers need an annual income of at least $119,769 to afford it with a 10% down payment.

That’s about $45,000 more than the typical household earns annually ($74,755). Even with a 20% down payment, home buyers would need to earn at least $98,202, still well above the typical salary.

The last year that the median buyer put down 20% was 1989, according to data from the National Association of Realtors (NAR). Today, the median buyer puts down just 15% of a home’s purchase price.

The median U.S. income earner ($74,755) with 10% down could only afford a home that costs $207,529 — 38% less than the current median-priced home.

A median-income family aiming to afford a median-priced home would need a hefty 45% down payment, or mortgage rates would need to drop from the current rate of 7.2% to 4% to make it work.

Even with a savings rate of $1,000 each month, it would take a household five and a half years to amass the $66,500 needed for a 20% down payment on a home priced at the median of $332,494.

As it stands, 61% of Americans find themselves priced out of the market even with a 20% down payment.

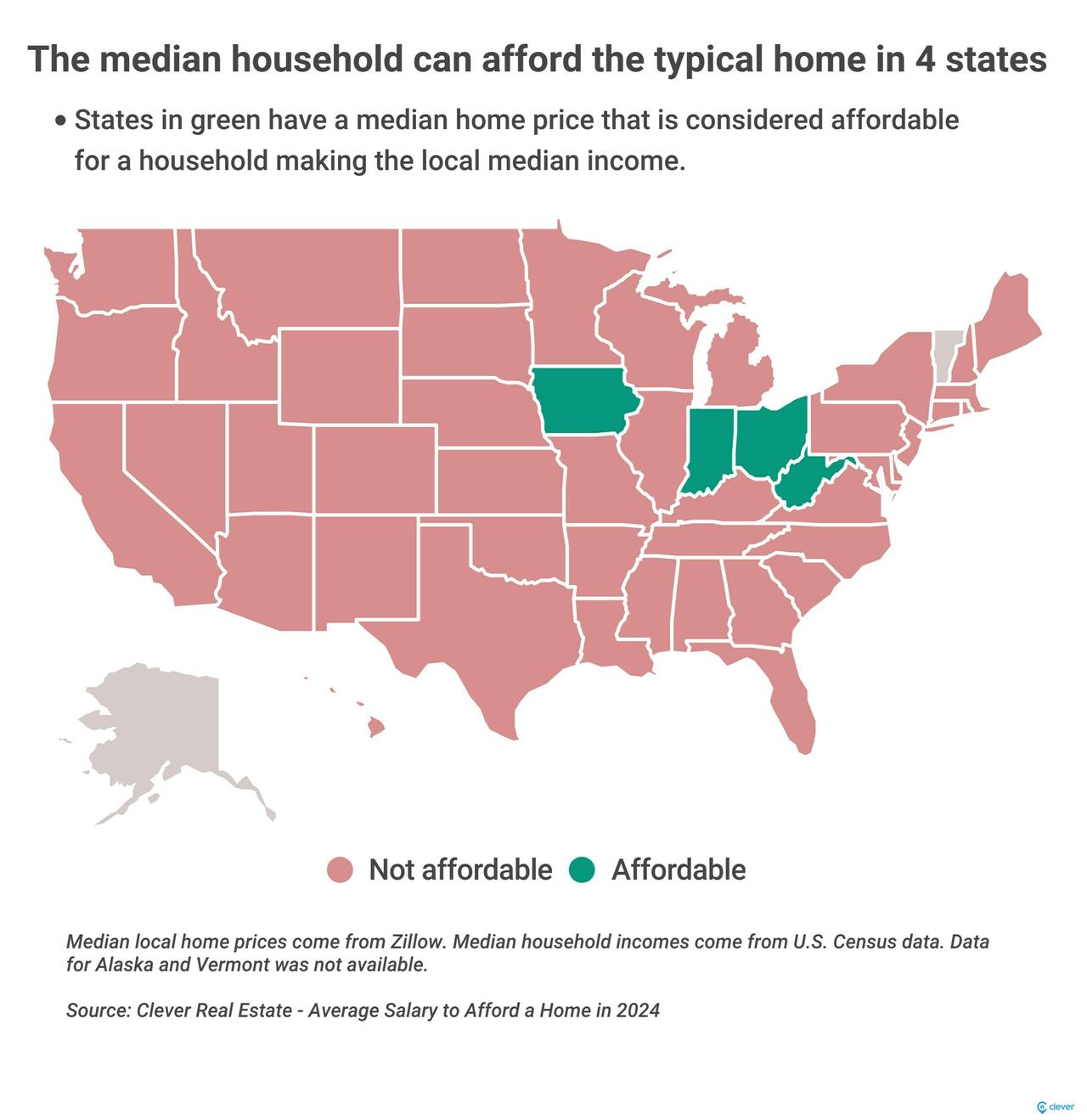

The median home is affordable for median earners in just four states (West Virginia, Ohio, Iowa, and Indiana)…

… and only six of the 50 largest metro areas:

- Pittsburgh, PA

- Cleveland, OH

- St. Louis, MO

- Memphis, TN

- Indianapolis, IN

- Birmingham, AL

Unsurprisingly, Los Angeles is the least affordable city, where buyers need an income of a whopping $249,471 to comfortably afford a median-priced home — nearly three times the actual median income of $87,743.

Read the full report at: http://www.listwithclever.com/research/how-much-house-can-i-afford-2024

Source: ZeroHedge

Top image: Pixabay

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Minds, MeWe, Twitter – X, Gab, and What Really Happened.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.