Wolf Richter: The State of the American Debt Slaves, Q3 2018

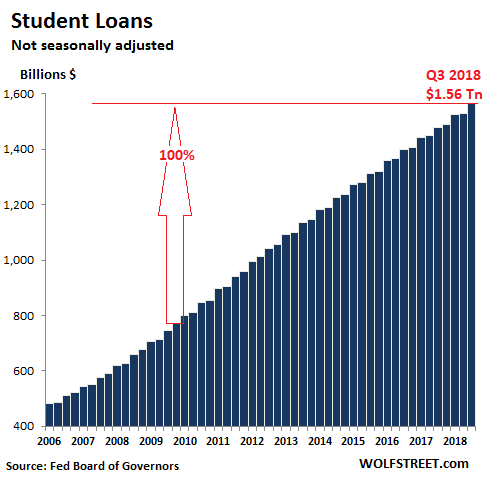

Looking at the sharp and steady surge of student loan balances, you’d think that student enrollment is booming, as millions more Americans must be enrolling in college to lean what it takes to be successful in this economy. But no.

Turns out, the opposite is the case. Higher-education enrollment peaked in 2010 at 18.1 million and then declined 6.6% to 16.9 million by 2016, according to the latest data available from the National Center for Education Statistics. And yet, even while enrollment declined since 2010, student loan balances nearly doubled, from $800 billion to $1.56 billion.

So the cause of the fiasco isn’t that there are too many Americans getting an education – I wish that were the problem. Instead a mix of factors stick out:

- Colleges are charging too damn much;

- Entire industries, such as consumer electronics and the student housing sector – a thriving subcategory of commercial real estate – are relentlessly sucking on those student loans;

- And occasionally, just a wee bit, the students themselves need to do some navel-gazing; These kids get this borrowed money, and it’s easy money to spend (iPhones, concert tickets, video games, nice housing rather than a dump, clothes…); later, it turns into hard money to pay back, and they’re left wondering how not to buckle under the debt.

And what do these factors of the student loan fiasco have in common? Ha, this is what makes the American economy tick: They all add to debt-fueled GDP!

“It’s time to wait patiently as the air is slowly let out of this bizarre Ponzi balloon created by the venture capital industry,” says a Silicon Valley investor who has been accused of being outspoken before and, after this, will likely be so accused again. Read… Startup Boom a “Dangerous, High-Stakes Ponzi Scheme”: Silicon Valley Investor