Can Government Prevent a Major Debt Crisis?

by Martin Armstrong, Armstrong Economics:

QUESTION: Hi Martin

QUESTION: Hi Martin

I recently stumped upon a documentary on Netflix about you and your model.

I then went on and watched some YouTube videos.

To me it makes totally sense that taxation does not work, but how can we change it. Do we need to become politicians?

We have a very high tax in Denmark. Base level around 39 percent and top level around 60. So it’s eminent to cajnge this in Denmark.

We have a quite new political party here called Liberal alliance. They promote a flat tax of 40 percent, and I think that makes sense…. But, they had such bad election and are so tiny now, they have no influence.

Everyone say we need taxes to have welfare. So how do we go from 60 to 0 percent in tax without sacrifice our welfare. And how do we convince people that it Wan work….. It will be some very tough months or years once the tax is not flowing to the hospitals etc?

I hope you can elaborate on these things.

DB

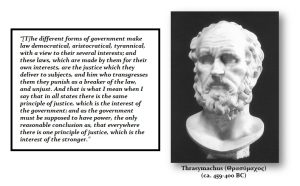

ANSWER: In building the model, I assembled data on everything I could find and then put it all together to see how and what made the world tick. I investigated tax rates to see how civilizations operated. I investigated what types of governments worked best and what always collapsed into oligarchies, then tyrannical entities, before collapsing into dust.

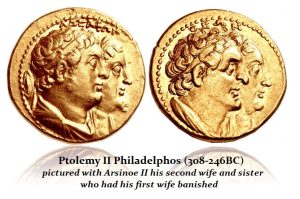

I read many contemporary historians directly rather than the modern interpretation of events, which have NEVER been unbiased. I discovered that inevitably people interpreted the past with a modern context. I found one of the funniest to be when they named the city of Philadelphia after the Greek meaning “brotherly love.” The founders were devoted Christians, and in their view, they loved their brother as they loved themselves. However, the real meaning in Greek meant incest — the brother was fooling around with his sister. Understanding the meaning in which words were used is critical to understanding history. You can NEVER read it in terms of a modern context.

I read many contemporary historians directly rather than the modern interpretation of events, which have NEVER been unbiased. I discovered that inevitably people interpreted the past with a modern context. I found one of the funniest to be when they named the city of Philadelphia after the Greek meaning “brotherly love.” The founders were devoted Christians, and in their view, they loved their brother as they loved themselves. However, the real meaning in Greek meant incest — the brother was fooling around with his sister. Understanding the meaning in which words were used is critical to understanding history. You can NEVER read it in terms of a modern context.

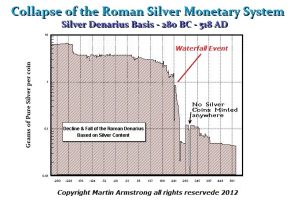

The Romans generally had a 7% tax. They also had welfare. The difference was that they had NOcentral bank and NO national debt. They controlled the mines and simply minted coins to fund the government and its programs. The Romans controlled the mine Rio Tinto in Spain, which they won from Carthage in the Punic War. The amount of silver they mined from that location funded the government for decades.

The debasement began in 64 AD under Nero when Rome experienced the great fire and Nero had to rebuild the city. As the new silver was declining, we find the debasement. It was not an issue of vote for me and I will give you this or that. The debasement begins because the government-funded itself with new money and the sources were running dry.

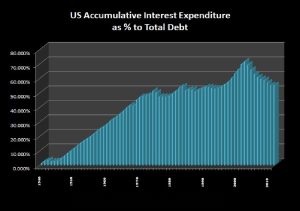

The problem we face is that it would have been far less inflationary to print the money than borrow it. We have a debt crisis that cannot be paid and the accumulative interest expenditures rose to reach at times even 70% of the national debt. Now that they have discovered NEGATIVE interest rates, they think they discovered a new way to tax people indirectly. They think we are too stupid to realize this is even a tax.

Read More @ ArmstrongEconomics.com

Loading...