Why Gold prices will continue to rise

by Virginia Fidler, Gold Telegraph:

The European Central Bank (“ECB”) appears to be considering lowering interest rates. The purpose is to make borrowing easier and stimulate the various economies of Europe. However, the result following previous rate cuts has been quantitative easing – when easy borrowing drives inflation.

The ECB is already at a deposit rate of minus .4 percent. There is little, if any, room to lower the rate further. The ECB is risking an increase in cash transactions and a reduction in bank deposits. This would almost certainly have a destabilizing effect on the economy. All this while the global economy is already slowing down.

The Federal Reserve Bank, and other global central banks, may be following suit and keeping their interest rate low, possible near zero or even negative.

Turkey’s central bank is expected to lower interest rates, as are the central banks of many emerging countries, such as Vietnam and Brazil. Central banks in South Africa, South Korea, Australia, Indonesia, and Chile will more than likely do that same. Smaller countries with a weakened economy are fearful that their currency will devaluate when the Federal Reserve acts. So, lowering interest rates now are preemptive measures.

Central banks are anticipating economic growth of 3.2 percent, and they are seeing lower interest rates as the means to that end. They are so eager to implement these policies, they may do so prior to the Federal Reserve Bank. This is an unusual move, as historically, the Federal Reserve Bank has set the president regarding global monetary issues.

The Feds are worried about the slowdown in the global economy as well as anticipated trade wars. They have already lowered interest rates as a signal that they might be moving into negative interest rate territory. Such a move will weaken the dollar globally. While it may not be the Feds’ intent, this will help weaker, emerging economies while slowing down the U.S. economy. Around the globe, the dollar is the reserve currency of choice. If the dollar has a higher value, other economies will feel that effect.

The move toward quantitative easing appears to be a collaborative effort in view of the move toward trade wars. Countries are pushing to protect their own currency.

The Swiss National Bank hasn’t increased its rates in more than four years. It has remained at minus .75 percent. Should the ECB cut its rate, however, the Swiss National Bank may lower its rates by another .25 points in an effort to uphold the value of the franc.

SNB Chairman Thomas Jordan would face pressure to support the ECB is its interest-rate-cutting policy, although Switzerland already has the lowest interest rate. Should the ECB cut its rates by 25 basis points, the SNB will almost certainly be forced to act.

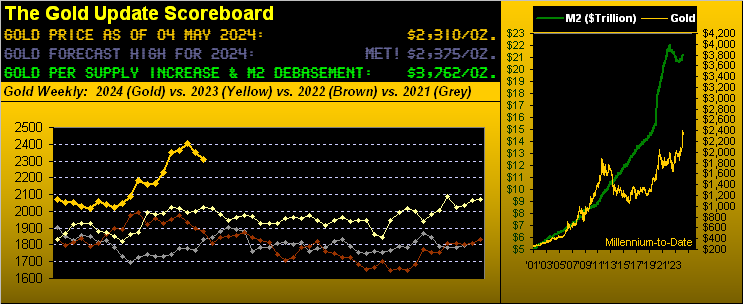

The good news in this morass of financial uncertainty is that the price of gold will rise. Investment in gold continues to remain strong amid the current global geopolitical tension. The price of gold rose at the end of June, when the Federal Reserve sent out signals that it was considering another rate cut. Historically, gold has been a haven in times of inflation and financial turmoil. The price of gold has reached an all-time high in many currencies around the world and is showing every sign of continuing that trend. As the dollar becomes devalued, gold can only increase in value.

Loading...