Central Banks Still On Gold Buying Frenzy, But “Bar & Coin Investment” Plunge Indicates Still No Love From John Q. Public

from Silver Doctors:

While it is no surprise that central banks still have gold fever, the (lack of) interest in bars & coins is quite telling…

The World Gold Council just released its latest report on gold demand trends for the second quarter of 2019.

Highlights include:

Central banks bought 224.4t of gold in Q2 2019. This took H1 buying to 374.1t – the largest net H1 increase in global gold reserves in our 19-year quarterly data series. Buying was again spread across a diverse range of – largely emerging market – countries.

Holdings of gold-backed ETFs grew 67.2t in Q2 to a six-year high of 2,548t. The main factors driving inflows into the sector were continued geopolitical instability, expectation of lower interest rates, and the rallying gold price in June.

A strong recovery in India’s jewellery market pushed demand in Q2 up 12% to 168.8t. A busy wedding season and healthy festival sales boosted demand, before the June price rise brought it to a virtual standstill. Indian demand drove global jewellery demand 2% higher y-o-y to 531.7t.

Bar and coin investment in Q2 sank 12% to 218.6t. Combined with the soft Q1 number, the H1 total ended at a ten-year low of 476.9t. A 29% y-o-y drop in China accounted for much of the global Q2 decline.

Gold supply grew 6% in Q2 to 1,186.7t. A record 882.6t for Q2 gold mine production and a 9% jump in recycling to 314.6t – boosted by the sharp June gold price rally – led the growth in supply. H1 supply reached 2,323.9t – the highest since 2016.

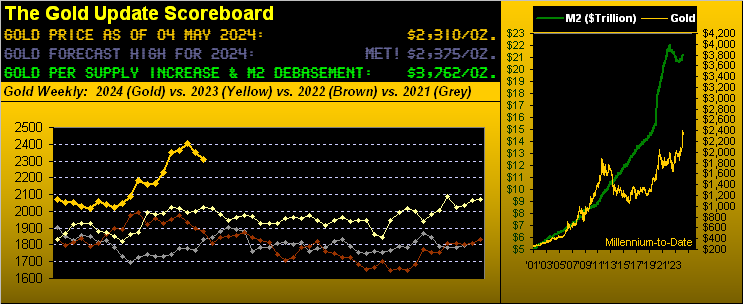

Gold prices shot to multi-year highs. The gold price broke through US$1,400/oz for the first time since 2013. Among the factors driving this rally were expectations of lower interest rates and political uncertainty, with further support coming from strong central bank buying.

Of course, we know why central bank gold buying is so strong.

In no particular order, here are some of the reasons central banks are on a gold buying frenzy:

- De-dollarization.

- Looking for ways around US imposed sanctions.

- Looking for alternatives means of payment and an alternative to the SWIFT system, the main way in which international payments are made.

- As a hedge against inflation and the reckless stewardship of the world reserve currency, the debt-based Federal Reserve Note.

- As a way to prepare for the coming global monetary and/or debt reset.

That is not the main point I’d like to make in this article, however.

I mean, we know central banks are mad stackin’ the shiny phyzz.

The point I’d like to make pertains to the sentence about “bar and coin investment” and the fact that it “sank” in the second quarter.

Here’s my point: The retail public does not yet have gold fever, and that means that premiums are still very low, and with this current price weakness, prices for gold (and silver) are very attractive.

Global central banks have access to the data, and by purchasing all of this gold, the various central banks are signaling that the global economy is about to be in for one rude awakening.

There’s talk about a “great awakening” of people to the evil in this world in general, and to the corruption in various governments specifically.

Loading...