20 YEARS OF GOLD MINING IN NEVADA: Six Times More Ore To Produce The Same Amount Of Gold

by Steve St. Angelo, SRSRocco Report:

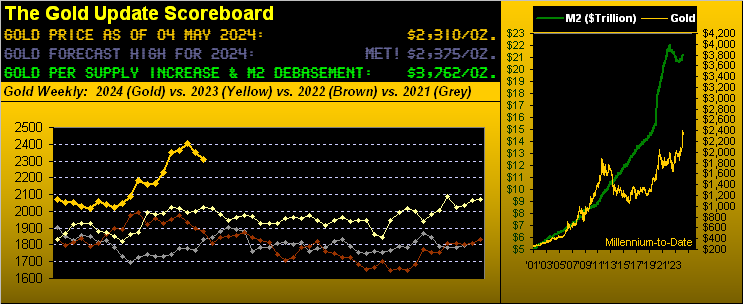

They say the exploding gold price over the past two decades was due to inflation, money printing, and the exponential increase in debt. While these have likely impacted the gold price, one aspect that is totally overlooked by the precious metals analysts is the most important factor called ENERGY.

Yes, ENERGY. Unfortunately, Just the mention of energy in my articles or Youtube videos, and my followers’ eyes start to glaze over. It seems as if most precious metals investors clamor for “sensational, shocking, or electrifying” news that will push the gold and silver prices higher. That’s really about it. So, if you mention E-N-E-R-G-Y to the typical precious metals investor, they will click to the next website.

However, if we try to keep an OPEN MIND and consider ENERGY’s role in the economy and with the precious metals, we will understand why it’s essential to own physical gold and silver.

For example, Barrick Gold’s Nevada Mining Operations now process six times more ore to produce the same amount of gold than they did just 20 years ago. It takes one hell of a lot of energy to move and process six times more ore produce 1 oz of fine gold.

I just updated this chart and was quite amazed by how much more ore Barrick processed at its Nevada mines in Q1 2020 to produce 526,000 oz of gold. In 1998, Barrick processed 6.0 million tons of ore to produce 2.3 million oz (Moz) of gold versus 12.3 million tons of ore in during Q1 2020 to produce 526,000 oz of gold.

IN JUST ONE QUARTER… Barrick processed twice as much ore than during the entire year in 1998 and produced one-quarter of the gold. And if we compare 1998 to 2019, Barrick processed six times more ore (36.7 million tons vs. 6.0 million tons) to produce about the same amount of gold.

This was a major factor that pushed Barrick’s production costs so much higher in their Nevada Operations:

Not only is the oil price more than four times higher today than it was in 1998, but Barrick’s average gold yield at its Nevada mines declined from 12 grams per ton to less than 2 grams per ton.

Even if the oil price averaged $25-$30 a barrel in Q2 2020, I don’t believe Barrick’s production costs will be that much lower than it was in the first quarter of 2020 when the oil price averaged $45.

I will be putting out a new video on the massive amount of fuel and energy now being consumed by Barrick at its Nevada gold mines. Due to the very low ore grades, it would be impossible for humans, without machines, to extract the gold.

Read More @ SRSRoccoReport.com

Loading...